Hey, Scott Stewart here…

I’m just going to come out and say it:

Wall Street has kept an extremely powerful piece of information “hush-hush” for the last two decades.

And what I’m about to share with you is something that will make a lot of people in the finance industry very unhappy.

But I simply don’t care.

Because you deserve to know what's in this document:

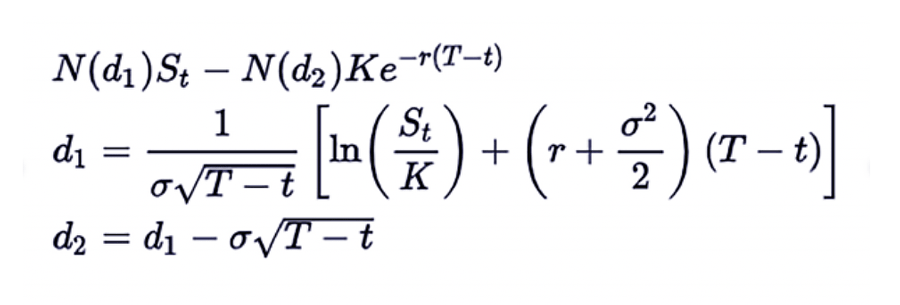

You see, what I am holding here is a Nobel Prize-winning formula that was awarded nearly 23 years ago totwo world-renowned economists.

In short, it’s a powerful tool that predicts the probability of profit you could make on certain kinds of trades.

So while you’ve been putting your hard-earned money in the stock market…

Making trade after trade to only end up feeling cheated and stolen from, from the fat cats on Wall Street…

The Elite Players have been quietly playing a different game that’s helping them make trades of 80% and nearly 90% probability of profit, resultingin major gains and successes.

That’s why you won’t see this on the news…

Or openly spoken about to regular folks like you.

I mean why would they want to share this?

The stock market is a zero-sum game…

When you lose… they win.

And that’sexactly why I’m wanting to get this message out to as many everyday Americans as possible.

Because the thing is…

I didn’t grow up with a silver spoon in my mouth.

We didn’t have a whole lot of money growing up, but my parents worked hard just like everyone else to build a comfortable retirement.

That’s why I stumbled into the finance industry as a stockbroker to begin with…

I wanted to help people obtain financial comfort in retirement.

But while I was taught to tell people that buying mutual funds, annuities, and “buy and hold” was the best way to make money …

I began to notice that the managers and tradersthat heldthe money were the ones cashing in the big checks.

It was at that point that I set out to utilize my connections in the finance industry to discover how they were playing the game to their benefit.

And once I discovered the formula that I’m holding in my hands…

I sadly realized that they didn’t want regular people like you to find out and understand how they used it to make these high probability of profit trades.

So because of that…

I walked away.

Call me crazy… but instead of ignoring the everyday American like the crooked Wall Street system, I walked away with a mission to get this ‘hush-hush” way of makingextra money out to the masses.

That’s when I partneredwith Robert Kiyosaki to teachpeople like you how to make more money in the stock market for you and your family.

Which is why, right now,I’m wanting to give you the chance to learn this unique way of making extra money in the stock market week in and week out.

In fact, the way I’ve applied it has already helped my readers see an 88% win rate this year…

And in this exclusive video, I want to share with you…

Robert and I reveal just how powerful this strategy really is.

But before I share it with you…

I really need you to listen closely and pay attention…

Because this is something that 99% of people have no idea how to use.

And if you learn how to follow this strategy…

It could transform your financial future and pay you many times over in thedays and months ahead.

Let me go ahead and play that for you now…

About a year ago, the famous author of Rich Dad Poor Dad, Robert Kiyosaki launched a project that has been changing the lives of real, hard-working Americans like you…

Everyday folks like nurses, teachers, mechanics, plumbers, truck drivers have been getting rich slow…

Making extra cash week by week… without buying stocks, bonds or other traditional income strategies.

Instead, they’re doing something Robert calls “trapping stocks”… an obscure income strategy that has stunned those who’ve tried so far.

You’re about to hear their incredible stories…

Real Americans like Matt S. a salesman from North Carolina. After making $500 in a quick trade, he said:

Matt S

North Carolina

“It’s nice to think that I may have found a way to add 20K a year to my income.”

Disclaimer: Our reader didn’t tell us, but we estimate they would have had to put an investment of $3,125 to make that much of a return in 30 days.

Or Sarah Friedman, a part-time teacher from Houston. She wrote in and said…

Sarah Friedman

“Hey Robert, just wanted to tell you I made about $2,794 on the last trade. I’m a part-time teacher so this is now an important part of my income, I would definitely recommend this as a reliable source of income.”

Disclaimer: Our reader didn’t tell us, but we estimate they would have had to put and investment of $17,462 to make that much of a return in 30 days.

Real Americans like Lewis Weeks, a truck driver from Nebraska. He’s made so much money that he told us:

Lewis Weeks

Nebraska

“Because I’m making money like this, I can now retire from truck driving early in 5 years instead of 10 years and I’ll be well off, not living tight.”

What are these people doing?

It’s time to find out…

HOST/JOHN: Hi, I’m John and I’ll be your host for today’s event…

I’m here sitting with the legendary Robert Kiyosaki, author of Rich Dad, Poor Dad… the #1 personal finance book of all time…

And one of his greatest cash flow specialists, Scott Stewart.

Together, they’ve been transforming the lives of real, hardworking Americans across the country…

Showing them an unconventional opportunity to get paid with a 30-day investment that arises every week.

Robert, before the cameras started rolling, you were showing me some crazy get-rich-quick promises that are out there…

But what you guys are doing is something totally different, right?

ROBERT: That’s right. Look at these ridiculous promises…

I see these things all the time.

Everybody's got the secret formula.

SCOTT: Look John, let me save everyone who’s watching this some time.

If you’re looking for one of those get rich schemes, you’re in the wrong place.

These real, hard-working Americans are NOT trying to make $1 million overnight gambling on bitcoin, pot stocks or some hot tip…

Instead, they’re following a no B.S. method of making money.

HOST/JOHN: Scott, I’ll tell you what… I don’t know about the folks watching this at home, but I wasn’t born rich.

I come from a middle-class family…

And today I lead a team of carpenters and finishers. So, we basically make custom cabinets

With my blue-collar background, I’d be pretty happy if I could make some extra cash every week.

So, what exactly are they doing?

SCOTT: They’re doing something we call “Trapping the Stock”…

We simply set a “trap” like this…

Using an obscure derivative trade, we’re setting boundaries around the stock… and making a bet the stock won’t move outside that box.

So when the stock ends inside this box… we’ve “trapped the stock” …

And you get paid.

HOST/JOHN: So the stock can go up or down… but as long as it ends inside the box you make money?

SCOTT: That’s correct. Even if the stock goes nowhere… we just have to “trap the stock”.

HOST/JOHN: That’s very interesting.

So I know you both started this project about a year ago…

And you’ve been sharing this secret with a small group of over 16,104 people.

I’ve done some research and I know these are just everyday folks.

So how is that going so far?

SCOTT: It has been incredible…

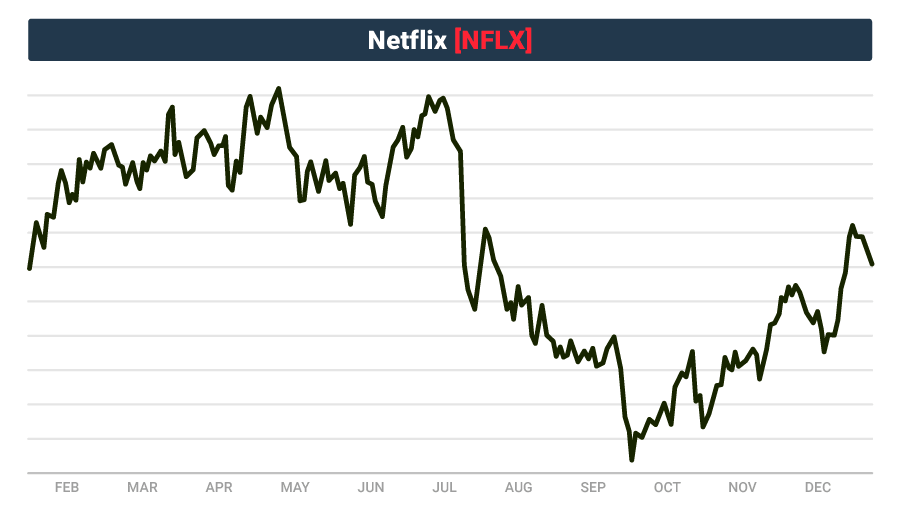

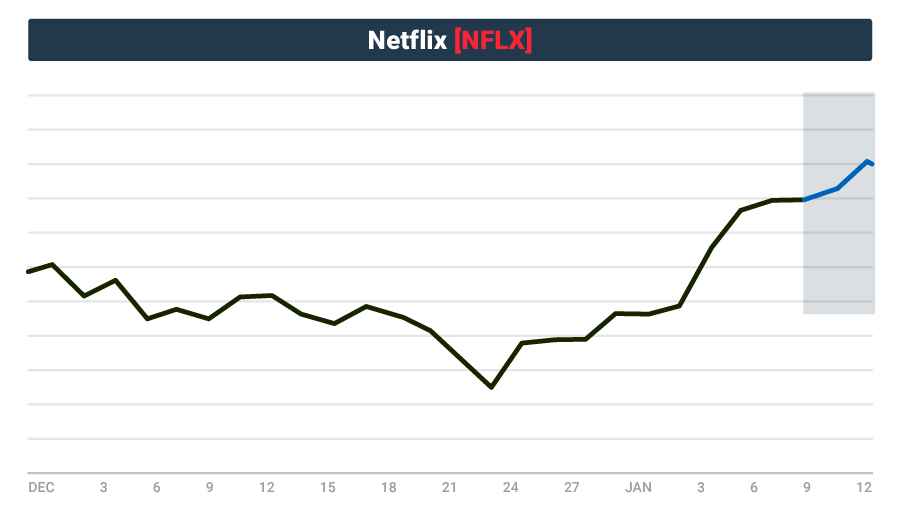

For example, look what happened when we showed them how to setup a “trap” for shares of Netflix…

Now, I think we can all agree that Netflix is a great company, right? They have an avid subscriber base of 139 million people worldwide.

But here’s the thing…

You never know what will happen to stocks… even if the company is great and profitable, shares could go down… or go nowhere for months.

In fact, had you bought shares of Netflix in January of last year…

You’d have made no money almost a year later because shares just moved up and down… and went nowhere.

That’s why instead of just telling this group to buy shares, we showed them how to set a “trap” for Netflix… like this…

So we were basically betting shares would end up inside this box…

HOST/JOHN: So this gave you a better chance to profit because you’re betting on a range of outcomes?

SCOTT: That’s correct.

In this case, shares finished inside the box… and anyone who listened to us put some extra cash in their pocket in just 30 days.

And these types of opportunities happen every single week.

So if you can make this kind of money over and over again, it could be life-changing.

HOST/JOHN: And anyone can learn this strategy?

SCOTT: Anyone. I mean my followers aren’t all professional traders or anything like that.

This is a strategy most people don’t know…

But hard working American’s all across the country were able to profit from this Netflix trade.

Disclaimer: Our Netflix play made an 11% gain in 30 days. Our average gain is 4.42% in 34 days.

Adriana Mynatt from Pennsylvania made $1,786.

Nick Hunt from Atlanta, Georgia made $1,037.

Sage Tracey from Indiana made $1,524.

Trevor Alberts from Alabama made around $1,800.

Cory Frost from Houston, Texas made $980.

Toby Winchester from New York made an astounding $16,500.

Karrie Hyland from Wisconsin made $873.62.

Will Edgar from New Mexico made $1,019.

Trent Adams from Michigan made $2,461 and said:

Trent Adams

Michigan

“This has taken the anxiety out of planning for retirement.”

Saul Rounds from Las Angeles, California made $867.78

Christopher Braddock from Mississippi made $1024.

Cassidy Britton from Texas made $684.

Taylor Wilmer from Arizona made $1,200.

Wesley Crawford from Arkansas made $,1600.

Tonia Seaver from New Jersey made around $1,000.

Dylan Payne from Washington made $2,060.

After making $2,450 on this one trade, Real Estate agent Hugh G. said:

Hugh G

Mississippi

“This is a solid, conservative way to generate positive cash flow & profit.”

HOST/JOHN: Wow… that’s just incredible.

Robert, you’ve been on a mission to help everyday folks get more cash flow ever since you wrote your bestselling book Rich Dad, Poor Dad in 1997.

So you must be really happy with these results, right?

ROBERT: Well, they love this guy and it's really in the testimonial.

We can make all the promises we want, but in the testimonials is where you know it works or not.

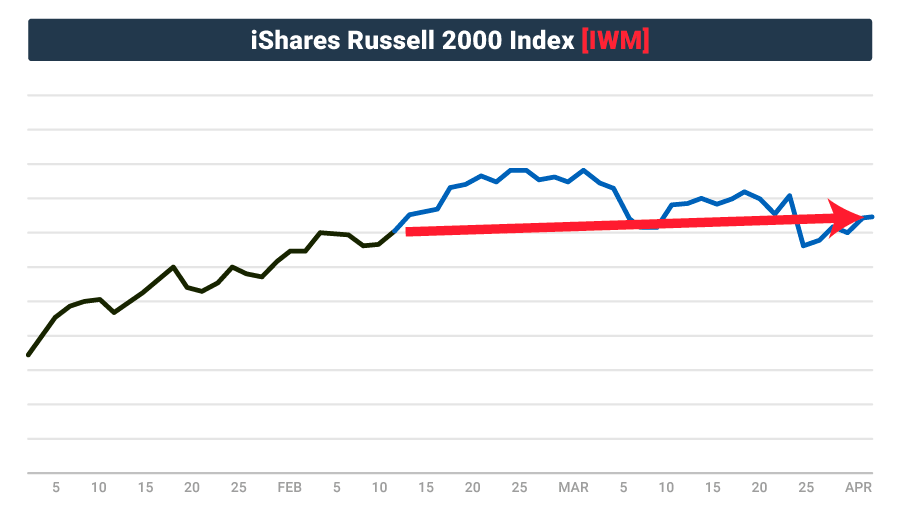

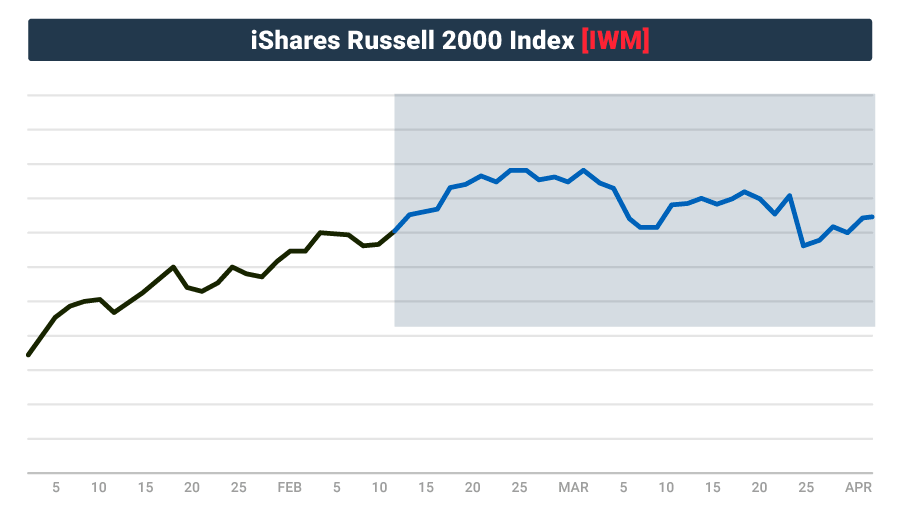

SCOTT: Look John, let me show you a chart right now… We’re going to put it on the screen…

This is a chart of IWM, an ETF that tracks the performance of small cap stocks.

As you can see, it went nowhere.

Do you think you could have made money from this?

HOST/JOHN: I don’t see how. If I had just bought shares, they didn’t really move… so I wouldn’t have made any money.

SCOTT: Correct.

And had you bought purely either a put or call options on this stock, you’d have lost 100% of your money because the option would have expired worthless.

And that’s why instead of showing these folks how to buy shares…

We sent a trade idea based on my market analysis showing them how to set a “trap” like this…

Keep in mind…

“Trap the stock” is the metaphor that I use for an options strategy created with multiple options, which I’ll explain more in depth later.

But don’t worry, you don’t have to be an elite trader to learn how to do this.

And when shares finished inside the box, anyone who placed this trade got paid.

People like part-time teacher Sarah Friedman who you mentioned earlier…

Even though shares on IWM went nowhere, she made $2,794 with this trade.

And she said:

Sarah Friedman

“This is now an important part of my income, I plan to use part of it to pay my bills. I would definitely recommend this as a reliable source of income. I am really experiencing the elevation of my financial well-being as Robert states the purpose of his mission.”

Disclaimer: Our reader didn’t tell us, but we estimate they would have had to put and investment of $17,462 to make $2,794 in 30 days.

HOST/JOHN: Robert, she’s referring to your mission “To elevate the financial well-being of humanity…”

I know that you prominently display that at the front door of your headquarters…

Can you tell us a bit more about it?

ROBERT: Well, the question I always ask is:

What does school teach you about money?

The answer is nothing, and you look at how many people are hurting today financially in the richest country in world history.

In my opinion, it's a failure of our education system.

So, that's where the story of Rich Dad, Poor Dad comes from. My poor dad was the head of education, Ph.D., but he's a poor man.

He teaches our kids, and my rich dad was a man without any financial education, without any formal education, but he became one of the richest guys in Hawaii.

So, I think financial education is one of the biggest problems, we have such massive problems in the economy today.

SCOTT: John, I think this project is doing wonders to help Robert with this mission…

Because that part-time teacher Sarah wasn’t the only one who made money from that trade.

Again, hard work Americans across our beautiful nation cashed in.

Disclaimer: Our iShares Russell 2000 Index play made an 16% gain in 30 days. Our average gain is 4.42% in 34 days.

Dale McGrath is a rural letter carrier with the US Postal Service in Alabama. He made $559.

He said:

Dale McGrath

Alabama

“If you’re interested in juicing up your retirement nest egg, take a look at this strategy”

Cassidy Britton a private piano teacher from Texas made $1,444

Oran Holloway from Washington State made $1,305

Jeremy Reed, a custodian from Ohio, he made $1,000

Jed O’Connell from Valentine Nebraska made $1,910

HOST/JOHN: Okay, Robert and Scott… for someone like me who’s just an everyday guy…

I gotta tell you… it’s just amazing to see everyday folks making this kind of money.

SCOTT: Well, here’s what really shocking John…

I’m going to tell you something right now that you’ll find unbelievable.

Are you ready?

And really…

I’m telling you… you’re not going to believe me.

You’ll think Robert and I are full of it.

Ready?

HOST/JOHN: What is it?

SCOTT: After about 82 weekly trades, we’ve had an 87% success rate…

That means 72 made money!

But look…I understand why you’re skeptical. Most people are lucky if they win 50% of their trades.

So I knew nobody would believe me.

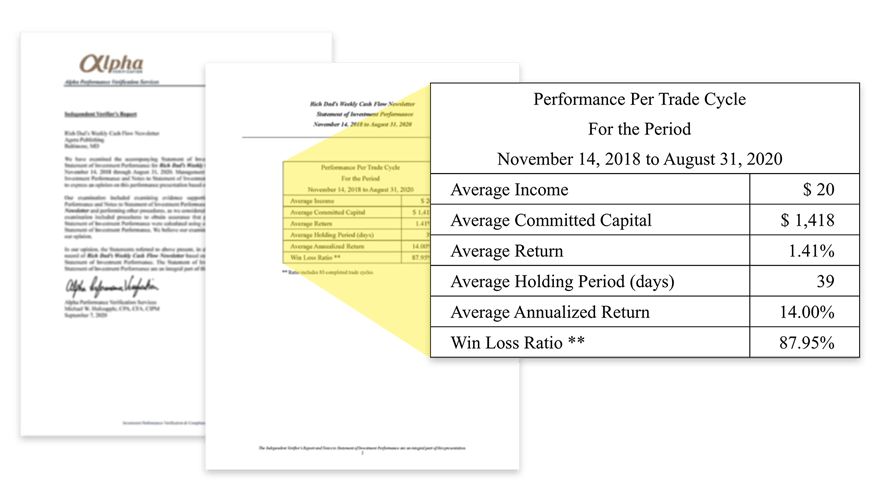

That’s why Robert and I had our performance audited by the highly respected independent 3rd party Alpha Verification.

They follow the Global Investment Performance Standards…

These are the same standards used to audit track records for the biggest money managers in the world…

In fact, more than $50 trillion worth of assets under management have been audited with these standards.

HOST/JOHN: Wow! So what you’re saying is you got the best of the best to verify your track record?

SCOTT: Exactly… they’re the real deal.

And you can see their independent report confirming our 87.95% win rate.

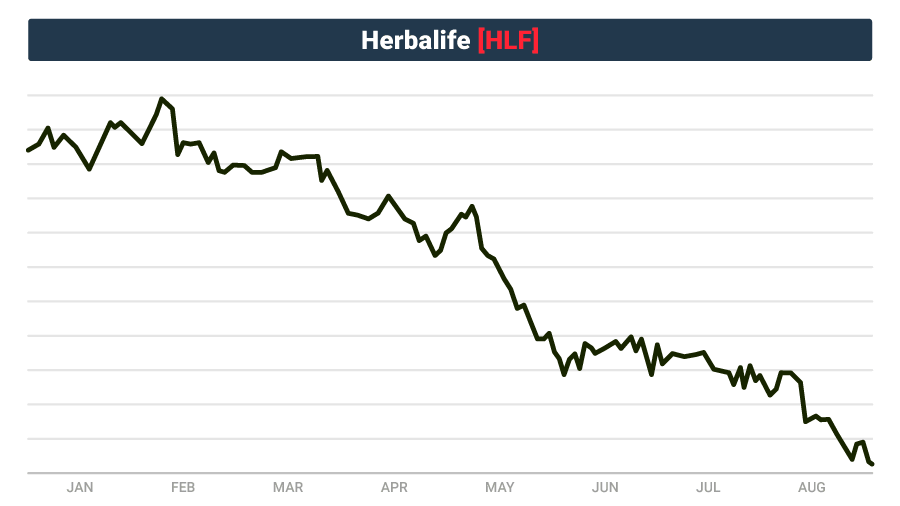

SCOTT: Look at what happened with shares of Herbalife (HLF) for example…

Had you bought shares at the end of December 2018, you’d be down 36% a few months later.

In other words, for every $10k you invested you’d be down $3,600!

So John, let me ask you this…

Based on what I’ve showed you so far, would you rather gamble your money just buying shares and hoping it will go up…

Or would you rather set up a “trap”?

HOST/JOHN: I guess based on your 87%-win rate, I’d say set up a trap.

SCOTT: Yep, that’s what we told them.

We showed folks how to set a “trap” like this…

Folks all across America made money from this because, even though shares went up and down the stock still finished inside the box.

Disclaimer: Our Herbalife Nutrition play made a 30% gain in 30 days. Our average gain is 4.42% in 34 days.

Scarlett Butler from Nevada made $3,280 she said…

Scarlett Butler

Nevada

“This is absolutely incredible, it even seems too good to be true.”

Trent Adams from Michigan made $514.

Tobias Albertson from Pennsylvania made $1,188.

Reanna Tyson from Ohio made $980.

Craig Cooper from Florida made $788.

Rolland Adkins from Oklahoma made about $700.

Kelsey Nelson from Tennessee made $1,114.

Howard Burgundy from South Carolina made $530.

John Abel from Kansas made $1,000.

Jimmy Lockwood from Texas made $655.10.

Buck Derrick from California made $681.

Fred Church from Alberta Canada made $1201.11.

Aria Howland from Wyoming made $927.

I’ll finish with William Correa from Illinois, who says…

William Correa

Illinois

“I made $2,588 on HLF. My goal is to get to the point that it covers my expenses…”

HOST/JOHN: Wow. That’s just amazing Scott.

Robert, William said that his goal is to use this extra cash flow to cover his expenses.

And I remember reading in your books that once you have enough cash flow to cover your expenses, that’s when you reach financial freedom, right?

ROBERT: When I say there's a million ways to financial heaven, there's also a billion ways to financial hell.

And all we're talking about here, what's Scott's talking about one trip to financial heaven, but you have to take the trip.

HOST/JOHN: So I understand this is not a get rich quick scheme… and you won’t make millions overnight.

But I’m looking at what these people are making, and I’m thinking…

This can really add up Am I wrong?

SCOTT: No, you’re 100% right.

Look what happened to Edward Steven from Orlando. In a little more than six months after we first went public with this, he said…

Edward Steven

Orlando

“I’ve just got above $110K. I've been paying attention to Rich Dad’s advice for many years now and found his analysis to be spot on.”

Disclaimer: Edward invested $250k to make $110K in a little more than 6 months.

Think about that…

That’s six figures in a little more than six months.

HOST/JOHN: Yeah, Most Americans don’t even make a salary of 110k in a year.

SCOTT: That’s right. And yet he made all that in a little more than 6 months. So it’s really an extraordinary example.

Of course, like any other investing strategy, there are risks involved too…

And that’s why I’d never suggest anyone invest their “mortgage money” on any single strategy, including this one.

I’ll explain more about how we manage our risk later today…

But John we keep getting these messages…

Like this note from Rich C., a 62-year old accountant from Chicago.

He sent me this note last year saying…

Rich C

Chicago

“I’ve already recommended this to several friends. Now that I understand how to [trap stocks], I am very excited about my future and may be able to retire early that expected.”

We’ve Received Hundreds Of Notes From These Hard-Working Americans…

Telling Us That Making This Extra Cash Flow Really Adds Up For Them…

HOST/JOHN: Wow. Robert, that’s very impressive.

Looks like you and Scott have accomplished something really special here.

I mean, I saw a piece of news the other day saying that Most Americans are just one paycheck away from financial disaster…

Millions of people are having a hard time paying the bills and putting food on the table without racking up debt

So to see these everyday folks making so much money, It’s just incredible

This could be a game changer…

I know at one point in your life, back in the 1980s, you’re struggling yourself…

I think I read in one of your books that at one point you and your wife Kim even had to live in your car for 3 weeks.

So can you talk about how cash flow changed your life?

ROBERT: Well, it's really financial education.

I didn't really care if I was homeless for three weeks, because I knew I could make my money back.

But if you don't have any kind of education, you don't have any mentors…

You have no somebody guiding you, holding your hand, naturally, you're in trouble.

HOST/JOHN: Thanks for sharing that Robert.

Scott, I’m still blown away by your 87% win rate.

So let’s talk a little more about that.

How is that possible?

Do you have a crystal ball?

SCOTT: No, we don't have a crystal ball.

This is actually only possible because of a fascinating discovery that even won a Nobel Prize in economics.

I’ll tell you all about it in just a moment…

For now, all you need to know is that this high win rate is very common with this type of strategy.

Here’s a good way to think about it…

Imagine a regular football goal post…

As you know, you have to kick the ball between those two posts to score…

Now imagine this…

What if we narrow the goal post…?

There’s still a chance you could kick the ball in-between the post and score…

But it would be a lot harder for you.

But imagine if we make the goal post much wider than normal like this…

It would be much easier for you to score, right John?

HOST/JOHN: Heck, even a 7th grade kid on the varsity team might be able to kick this one in.

SCOTT: Right, and that’s what we’re doing when we set these “traps”.

We’re setting boundaries that are wide enough… so it gives us the best chance to profit from our investment.

The underlying stock can move up, down, or sideways before the play expires…

It just needs to finish inside the box for you to get paid.

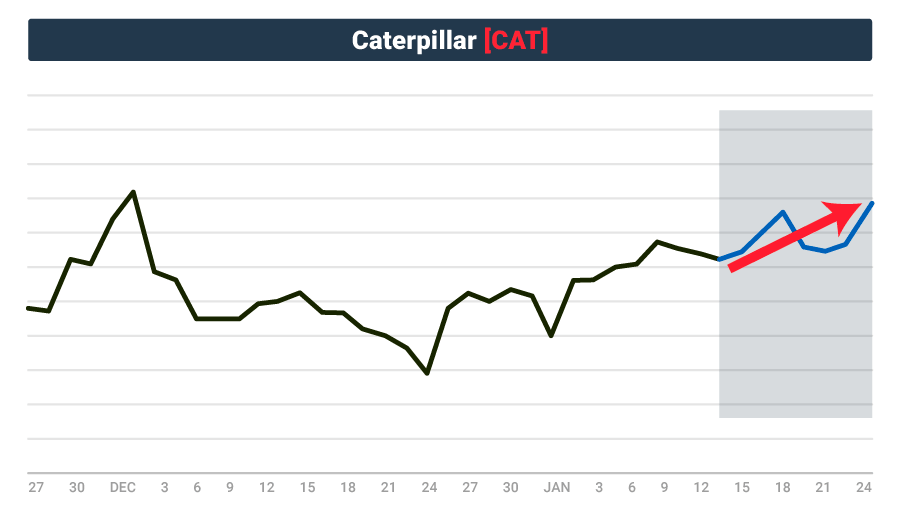

Look what happened with shares of one of the biggest construction companies on the market – Caterpillar Inc.

We showed folks how to set up a “trap” like this based on my research… as you can see, we gave it enough room for the shares to move…

That increased our odds of winning.

Sure enough… it ended inside the box.

HOST/JOHN: So, the folks who followed your work made some money on this trade too?

SCOTT: They sure did…

Once again, people from all across America cashed in on this…

Disclaimer: Caterpillar Inc. saw a 4% gain in 9 days. Our average gain is 4.42% in 34 days.

Adriana Mynatt from Pennsylvania made $1,400.

Hugh G. from Mississippi made $1,289.

Jack Edwards from Oregon made $617.

Jordan Bull from North Carolina made $4,500.

Adrian Robbins from Massachusetts made $500.

Karrie Hyland from Wisconsin made $848.92.

John Abel from Kansas made $3,100.

HOST/JOHN: Ok, so I think I understand now why your win rate is so high…

It’s just the way the strategy works.

But that means this could be a consistent way of generating some extra cash for certain individuals, right?

SCOTT: Of course.

It’s because of the high probability of this strategy that we get emails like this…

Rick S. who works in manufacturing in Denver said:

Rick S.

Denver

“it’s a relatively safe way to huge profits. We've done around 20 trades, all virtually profitable. After working my whole life for $$, Scott got me to think about having $$ work for me and my family.”

And Jim Rostrum says:

Jim Rostrum

Chicago

“I’m at $32,133.53 now. I’d recommend this to my friends because who would not like to make twenty-five trades with no losses?”

Disclaimer: Jim Rostrum had been a subscriber with us for over 7 months at the time he submitted his testimonial. He didn’t tell us, but we estimate that he started with $428,450 to make $32,133.53 during that time…

HOST/JOHN: Guys, this all sounds great.

I can see that these folks are making 100s and 1,000s from a single trade… and how doing that again and again is really adding up over time.

In fact, this is so incredible that makes me think…

Why isn’t this in the headlines in every financial newspaper?

I mean, this group of hard-working Americans are already cashing in…

But most folks out there probably never heard of this strategy.

How is that possible?

Robert, why don’t brokers on wall street and financial advisors tell us about this cash flow technique?

ROBERT: Well, if I could speak bluntly right now, I am a U.S. Marine.

Two tours in Vietnam as a pilot, so I don't like mincing my words.

So I'm going to tell you straight. they talk about fiduciary. Are financial planner’s fiduciaries?

SCOTT: No.

ROBERT: No. Fiduciary means I care more about you, Scott.

I really do care about you.

The truth is financial planners make money even if you lose money, is that correct?

HOST/JOHN: Absolutely

ROBERT: And that's why these guys with those 401Ks and IRAs are a bunch of losers.

The world has changed since the pandemic has hit, but the biggest thing pack of losers are what's called the passive investor.

And those are the rich guys and they're the ones who are kind of screwing the economy right now.

They're the ones who have the sane to say, "Don't fight the Fed."

Well, I've got bad news for you. The Fed's broke.

This pandemic has welled the Fed's money out of the water.

Their balance sheet looks like a pawnshop. They've got crap on the poncho.

So I'm a Marine, I'm going to tell you straight: you better find your own formula.

So, I'm not saying Scott has the only formula, but I trust his formula.

I trust him because he can teach the formula.

I trust him because people have good results from the formula.

His formula and my formula are not the same. I'm more of a real estate guy.

So, the point here is this, you got to find your own formula, right?

SCOTT: Right. I mean look John, I can’t really blame folks for not knowing about this strategy.

We’ve all been trained to just buy stocks and hope for the best.

Do you remember that old saying they tell everyone?

“Buy low, Sell high”

HOST/JOHN: Yeah, that’s what Wall Street tells you to do… buy stocks and hold for the long-term.

SCOTT: Yeah, they rely on one dimension…

But what are the chances you’ll guess when the market is going to rise…

And then exit exactly at the top?

And it’s not just stocks…

See, Wall Street “trains” their financial advisors and planners with ineffective methods…

Like putting your money in a savings account that pays 1%…

Or a treasury that’ll give you less than 3%…

But both those methods barely beat inflation.

And if you want more income for retirement, maybe they’ll set you up with dividend that pays 4-6% a year at the most.

In other words, you’d need $1 million invested in one of those stocks to make $40k a year…

John, do you have $1 million laying around?

HOST/JOHN: No, I don’t.

ROBERT: Exactly. And let me add something to this.

These guys who are passive investors, these financial planners, they tell you to invest in the S&P500…

That means you just wasted 475 stocks that are worthless.

Why would you invest in 500, right? Would you do that?

HOST/JOHN: No,no.

ROBERT: Plus 475 out of the 500 are losers, but that's what they'll tell you to do.

SCOTT: See, most passive income methods available to the average person nowadays are outdated and ineffective.

But here’s what’s really shocking…

While Wall Street tells everyday folks to put their money in failing 401ks and other “buy and hope” strategies that never work…

Guess what they’re doing with their money?

HOST/JOHN: Don’t tell me they’re “trapping” stocks?

SCOTT: That’s exactly what they’re doing.

A lot of the pros on Wall Street are using this exact same strategy to make a fortune.

Randy Frederick, managing director at Charles Schwab said: “[This] is typically designed to be a neutral, low, low risk strategy… Losses are limited, that’s the nice side of it.”

Even Fidelity, one of the biggest firms on Wall Street, has admitted that the strategy behind “trapping stocks” offers, and I quote, “high-probability income with limited risk.”

HOST/JOHN: Now Robert, it sounds like we can’t trust Wall Street, right?

ROBERT: You can't trust Fed. You can't trust a Treasury.

I'm trying to tell you something, the Fed is dead.

This COVID-19 has blown them out of the water.

They're out of cash. They've been buying junk, trying to keep the stock market up.

So, that's why what Scott is doing, he's telling you to be picky, to be choosy, to come up with a precise formula…

Rather than going to your financial planner, who's going to make money whether you make money or not, and you're going to buy, hold and pray.

HOST/JOHN: I mean it just blows my mind that wall street doesn’t share this strategy with everyday folks.

But Scott, how do you know all that?

Do you work on Wall Street now?

SCOTT: Not anymore, but I used to.

I began my career as a stock broker in the 1980s…

Then I went to work in venture capital for a while, taking private companies public.

In the 90s, I became a licensed financial planner… and at one point was managing millions and millions of dollars.

But I have to confess…

At that point I was doing what every other financial planner on Wall Street does…

Putting people into mutual funds and hoping to get an 8% annual return at best.

And at the time I thought 8% was good because all they taught us back then…

But everything changed in the late 90s… and because of this man. [Scott points to Robert]

HOST/JOHN: So, what happened?

SCOTT: Well, around that time, Robert published his best-selling book Rich Dad, Poor Dad…

As you know it went on to become the #1 personal finance book of all time.

I mean…

Through his books and seminars, Robert has changed the lives of millions of people around the world.

INCLUDING MINE.

I mean, thanks to his lessons I quit my 9-5 long before retirement…

Now I get to spend as much time as I want with my family.

And make money trading from the comfort of my home…

HOST/JOHN: So,that’s great. I know Robert’s lesson have helped millions escape the rat race.

SCOTT: Yes… That’s why he’s often invited to discuss money on NBC, CBS, CNN, Fox News, CNBC… you name it.

More important, he’s living proof that his strategies work.

He’s too humble to say this… but He retired rich at the age of 47…

When it comes to collecting passive income, I can’t think of anyone better than Robert.

HOST/JOHN: So how did you two meet?

SCOTT: Well, when I had the chance to meet him back then, I grabbed the opportunity with both hands.

And later on, I was asked to join the Rich Dad team.

And that was around the time I first learned about this little-known income method.

Something I bet 99.9% of the people out there don’t even know exists

And Now We’re Sticking It to Wall Street and the Rest of the FAKE Financial Industry

HOST/JOHN: You’re talking about this project you started about a year ago?

SCOTT: Yeah, that’s correct.

Every week for the past year or so, I have been sharing this strategy with a small group of 16,104 people.

HOST/JOHN: Every week?

SCOTT: Yeah… every week there’s a new opportunity…

In fact, in just a moment I’ll tell you about an opportunity to “trap” a stock tomorrow…

HOST/JOHN: Tomorrow? That could mean money in your pocket tomorrow?

SCOTT: That’s right. Yeah, every week, there is a new opportunity.

In fact, in just a moment, I'll tell you about an opportunity to trap the stock tomorrow

Because the way this works… you collect cash instantly when you set up the “trap” … and if the stock finishes inside the box, you keep that money.

And the best part is anyone who learns this strategy can use it for the rest of their life…

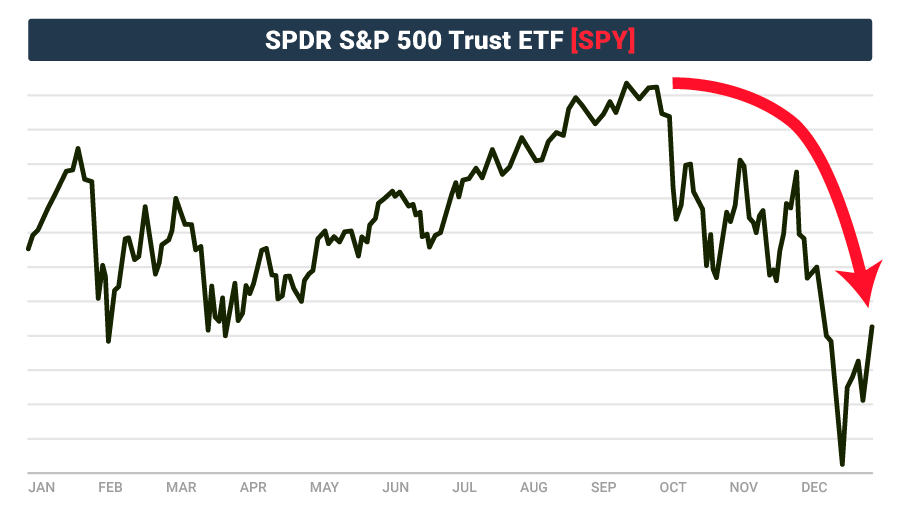

Because it’s adaptable to all different types of market environments…

Just look what happened with stocks at the end of 2018…

In a few months, stocks collapsed by over 19%, leading CNN to say…

At the lowest point, the average 401k of a 60+ year old who was invested in the S&P would have lost more than $37,000.

It was a scary time… very volatile. But while most people were losing money…

We showed them how to set up a “trap” for the S&P 500 index like this …

HOST/JOHN: So even if it went down further, but stayed inside the “trap” they’d make money?

SCOTT: That’s correct.

Once again, it finished inside the “trap” …

And this gave people like Jimmy Lockwood a $1055 win… excitedly he told us:

Jimmy Lockwood

Texas

“This was Super easy! I LOVE LOVE LOVE LOVE LOVE [trapping the stocks]! This is the best financial decision I've ever made!”

Disclaimer: Our reader didn’t tell us, but we estimate they would have had to put an investment of $4,000 to make $1,055 in 36 days.

HOST/JOHN: WOW, he does seem excited.

Robert, you often talk about the dangers of just buying stocks and hope for the best.

Do you think folks who are blindly investing like that are taking unnecessary risks?

ROBERT: Yeah.

The story of Rich Dad, Poor Dad is a story of two teachers, and the thing I'm really thrilled about Scott is he's a great teacher.

When you find a great teacher, hang on, because Scott's results are not in what Scott says, but what happens in his students…

and I'm very happy because the feedback I'm getting from your students they're happy, I'm happy.

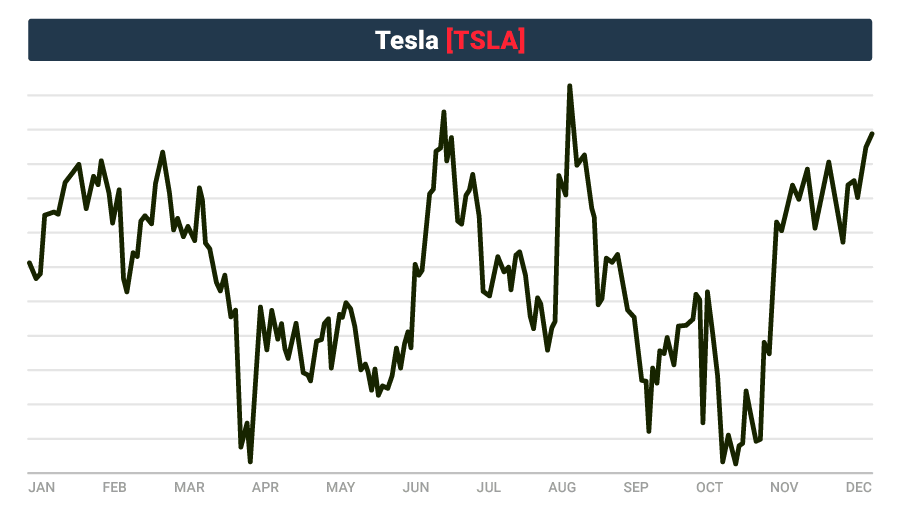

SCOTT: Look John, the nice thing about this is you can even make money from the most volatile stocks in the market.

Take Tesla for example…

Throughout 2018, the stock went up and down… up and down… looked like a roller coaster.

John, forget about how you feel about the company Tesla for a bit…

But just looking at this chart… how confident are you to make a directional bet that shares will go higher?

HOST/JOHN: Not very confident.

SCOTT: Exactly. And that’s why instead of telling people about shares they could buy and hold for a year…

We showed folks how to set a “trap” like this and they were out within days…

HOST/JOHN: Alright, so let me guess… the underlying stock finished inside the “trap” and people all across America cashed in?

SCOTT: Yeah, exactly.

People like Mark Harrington from North Carolina. After making $1,200 on this tesla trade, he said:

Mark Harrington

North Carolina

“I’m planning to grow my account every year. This is so fantastic that I have even told my two brothers and a few friends about it.”

Disclaimer: Our reader didn’t tell us, but we estimate they would have had to put an investment of $6,300 to make $1,200 in 16 days.

HOST/JOHN: And was Tesla the only volatile stock you’ve targeted?

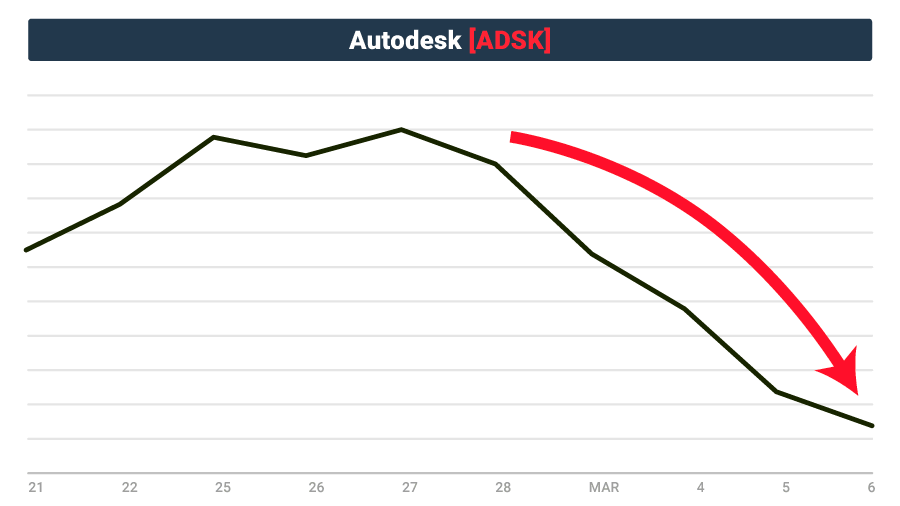

SCOTT: No, let me show you another example with shares of Autodesk…

If you had simply bought shares back in March, it would have seemed like the worst timing…

Because they were in a down trend…

In fact, on NASDAQ.com they dubbed it the “Bear of the Day”

Calling it a “Strong sell” because their “earnings estimate was moving in the wrong direction.”

So instead of just telling people to buy shares, we showed them how to set up a “trap” like this…

Of course, at the time nobody knew if it would keep falling or recover.

But the “trap” gave us some breathing room.

And in this case, shares went up a bit, and finished inside the box.

HOST/JOHN: I actually saw a note from someone who made this trade. Let me put this on the screen because I want to ask you a question Robert.

Shane Miller from New Orleans said:

Shane Miller

New Orleans

“I made $1,830.66, this is a great way to make some extra money. Robert and Scott’s ideas definitely have changed the way I think about investing and made me realize what I have learned in school and on the job was only true in part and sometimes even wrong. Also, I feel more relaxed about the future and much less concerned about having enough money for retirement.”

Disclaimer: Our reader didn’t tell us, but we estimate they would have had to put an investment of $2,904 to make $1,830.66 in 69 days.

Robert, I think Shane is referring to the fact that school doesn’t teach anything about money or cash flow, right?

ROBERT: That's correct.

And that's why we have so many millions of people in financial trouble today.

HOST/JOHN: OK, so I’m glad you and Scott are doing everything you can to share this obscure cash flow strategy with everyday folks.

And I can’t wait to hear more details about this opportunity that you found for tomorrow…

But Scott is there a way to tell how much you’ll make ahead of time?

SCOTT: Well, it all depends on how much you’re willing to invest.

So I can’t guarantee you’ll make the same money these folks are making because results vary…

HOST/JOHN: Yeah, I’ve noticed some people collect more than others…

Ok, so Scott… you mentioned before…

You have been able to win 85% of the time since you’ve launched this project.

So I’d like us to talk more about how this actually works…

Can you give us details?

SCOTT: Sure, this stuff can get complicated behind the scenes.

There’s a ton of math involved.

Luckily, we have highly efficient computers to do all of the hard calculations for us.

As a matter of fact, this is the formula we use to determine the parameters for what we call a “Trap”.

HOST/JOHN: That looks complicated.

Scott, you invented this formula?

SCOTT: I wish I could take credit…

But this was something I actually discovered while doing research after Robert became my mentor.

See, this formula was developed by 2 geniuses who worked on Wall Street…

Myron Scholes and Robert Merton… they even won the Nobel prize in Economic Sciences because of this formula.

And by using it, you can actually calculate the probability of a stock landing in your “trap”.

HOST/JOHN: So, what do you mean?

You can see the probability you’ll make money before you open the trade?

SCOTT: That’s correct.

I don’t have to do the complicated math because the computer will do all those calculations for us.

Of course, this is just an estimated probability, nothing is guaranteed in the markets.

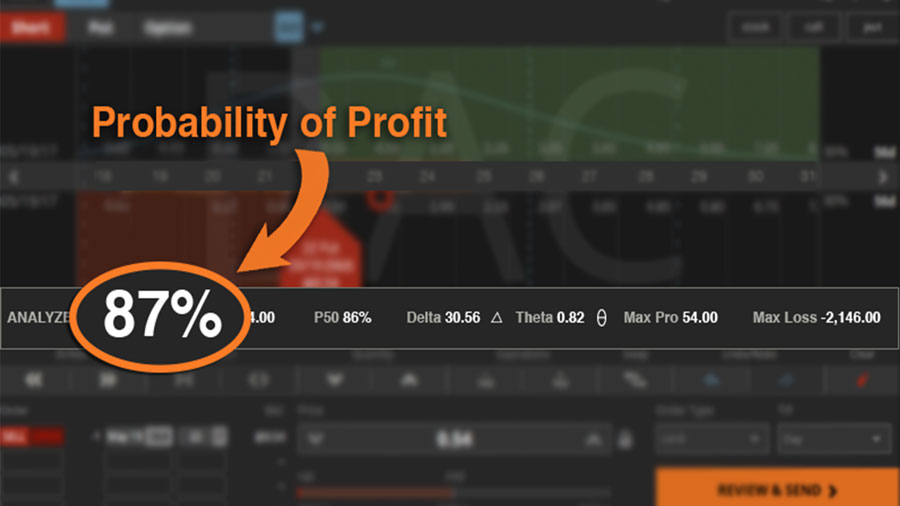

But I simply set the boundaries for the “trap”… then I can actually see the probability of profit on the screen.

Here let me show you how it looks on my computer…

HOST/JOHN: That’s amazing Scott. I never heard of that before.

I mean, usually when you buy a stock you’re basically flying blind.

Nobody will tell you what’s the probability of making money.

SCOTT: That’s why I love setting up trades using this strategy.

And it’s what allowed us to have over a 85% success rate so far.

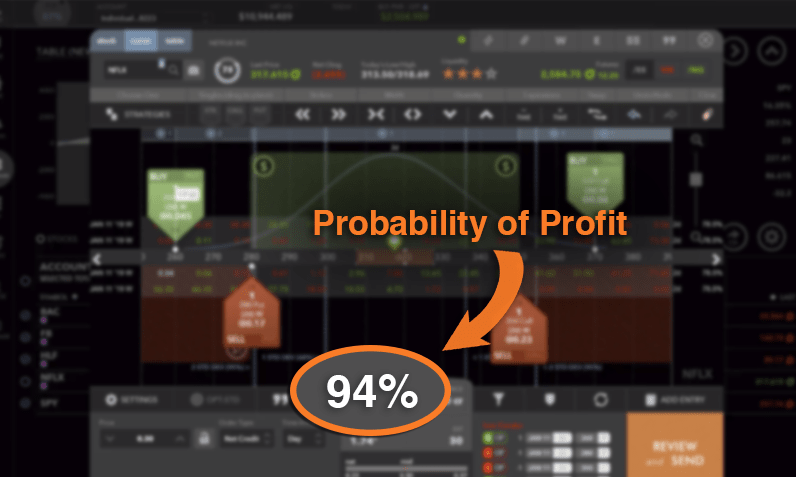

For example, when I saw an opportunity to “trap” shares of Netflix…

I set the boundaries of the trap…

And then the computer told me there was a 94% probability that underlying shares of Netflix would end inside the box …

HOST/JOHN: So before you shared this trade idea with anyone, you knew there was a 94% chance of making money?

SCOTT: That’s correct.

So, based on my market research, I sent an email to folks showing them how to setup up this trap on shares of Netflix…

People like Trevor Alberts from Alabama.

After cashing in, he said,

Trevor Alberts

Alabama

“To be honest, I was very skeptical at first… But after I saw a bunch of trades were profitable, I jumped in.”

HOST/JOHN: I can’t blame Trevor for jumping in.

This is just amazing.

But how are you actually setting those boundaries for the stock?

How do you set up what we are calling a “trap”?

SCOTT: Well, remember that formula I showed you earlier… the one that won a Nobel Prize?

That’s a formula that pros on Wall Street use to price options.

And if you know what to do, you can actually use option transactions to set boundaries for the stock.

Folks, 70% of trading really is just managing your own emotions, and if we can put systems and controls in place to manage our risk versus our reward and how many trades are winners versus losers, managing the probability of profit, then we are successful. And successful traders do this by keeping rules like how much money you can risk losing on a single trade.

HOST/JOHN: But I heard when you buy options you can lose 100% of your money if you’re wrong.

SCOTT: That’s correct.

But we’re not just buying them to speculate on the direction of the stock, like most people do.… we’re playing them a way that helps mitigate risk in the options market. To be clear that doesn’t mean eliminate risk.

The number one rule of risk management, guys, is that we are always, always, always going to use a stop loss of some kind. We are never going to just put on a trade, cross our fingers, and hope for the best. We are going to manage the risk in these options trades.

We’re buying & selling a couple of different options… and that’s what sets the boundaries of the trap.

And when you open the trade, your money gets deposited in your account.

If the trade finishes inside the box, you get to keep that money.

That’s how you get paid.

I’ll explain what happens when the trade finishes outside the box in just a moment… because remember, our win rate is not 100%. So that means we’ve lost too.

But first…

Just to make sure you really understand, I recorded my computer screen when I opened one of these trades for illustrative purposes only… let me play that for you now…

HOST/JOHN: Ok, now I definitely get it.

Robert, I know you’re not an options trader

Is that why you have an options expert like Scott in your team?

ROBERT: Well, I'm kind of an options trader, but in the real estate market.

I love, do you know what I mean?

That's called leverage.

But anyway, the point here is, if you're looking to get ahead in this brave new world post COVID-19, you really need to not listen to Wall Street anymore.

That is my message and you want to find a great teacher whose students are happy, the feedback is good, and that's when I'm happy.

There's a million ways to financial heaven, but there's a billion ways to financial hell, and a lot of people are going to hell right now.

HOST/JOHN: That’s great.

Scott, earlier you said you often see an opportunity to setup a “trap” for stocks every week?

SCOTT: That’s right. In fact, I’m getting ready to blast out an email with a brand-new trade idea tomorrow.

HOST/JOHN: So, that means anyone who gets that email will have a chance to set up one of those “traps”?

SCOTT: Yep, you see… every week I target trades that have an 80% or higher chance of making money…

When I find a good opportunity, I send an email to my readers…

You know, the real hard-working Americans I’ve been telling you about today.

HOST/JOHN: And what’s in those emails?

SCOTT: Well,

Let me show you…

As you can see, I include detailed instructions on how to set up the trade with all my research…

We explain the opportunity…

It includes an analysis from both myself and Robert…

No technical jargon… Just plain and simple English anyone can understand.

And I even add a full video walk-through…

So there’s no guessing work. If you want to participate you just watch the video and follow step by step.

This is all part of a research service called Rich Dad’s Weekly Cash Flow.

HOST/JOHN: So those people you’ve been telling us about are all members?

SCOTT: They are.

And I’m going to send them an email tomorrow with my all my analysis for the latest cash flow opportunity.

HOST/JOHN: Now Scott, based on what all the other members have said so far…

That means tomorrow’s email could be another opportunity to collect some fast cash.

SCOTT: Well, that’s right…

And remember… That’s just the beginning.

HOST/JOHN: So, those people you've been telling us about are all members?

SCOTT: They are… and I'm going to send them an email tomorrow with all my analysis for the latest cash flow opportunity.

HOST/JOHN: Now, Scott, based on what all the other members have said so far, that means tomorrow’s email could be another opportunity to collect some fast cash?

SCOTT: That’s right and remember, that’s just the beginning. I send my readers a new trade idea every Wednesday.

That’s 52 chances for you to generate that kind of money every year.

Like I showed you, so far, I’ve won 87% of the time.

HOST/JOHN: Ok, that sounds great.

But what if I’m new to this type of opportunity?

SCOTT: No worries. In fact, as I mentioned earlier, 99.9% of Americans do not know about this type of trade.

I’d bet all of our members had no clue this was even possible…

And yet, you’ve seen the results… everyday folks, nurses, truck drivers, teachers, plumbers… they’ve all learned how to make this type of trade.

That’s because we put together a great educational video that walks them through everything you need to know to get started.

So when you join us today, you’ll also get a FREE masterclass…

That’s our…

Surprise Bonus #1: A 10-part video series Masterclass called Cash Flow Zone Academy

HOST/JOHN: That’s great Scott.

Robert, you’re always talking about the importance of financial education…

And sounds like people who already watched these videos are seeing great results. Can you speak a bit about that?

About the importance of learning about investing?

ROBERT: Well, again, school teach us nothing about money…

But I'll just say this to each and every one of you because this is what my rich dad told me…

He says, "In each and every one of us is a rich person, a poor person, and a middle class person."

And so my Rich Dad said to me it's up to me to choose who comes out, the rich person, a poor person, a middle-class person

And I cannot stress this enough, COVID-19 changed the world.

If you're hoping Wall Street is going to make you rich, I'll pray for you tonight.

SCOTT: Look John, I’m really happy that people are making a ton of money from this strategy.

But believe it or not, I’ve gotten a ton of notes from people telling me how much they loved this masterclass…

People like Sandra Connelly in Cleveland. She said:

Sandra Connelly

Cleveland

“Superb education that goes beyond making money. I am impressed by the mission to educate and the commitment to education by the Rich Dad team.”

William Correa from Illinois says…

William Correa

Illinois

“Cash flow is the way to go and this approach has been fantastic. The instructions and training are of far greater value than the money. I will never see the world the same again. I can see a path that will take me out of the rat race.”

Wesley Crawford said:

Wesley Crawford

Arkansas

“This is very easy. I love the training videos because they are very informative and easy to follow.”

HOST/JOHN: That’s amazing. The money is great, but you’re also empowering people to take control of their finances.

So what exactly do you teach in this masterclass?

SCOTT: In this 10-part video masterclass, I’ll show you…

- How to setup a “Trap” for the underlying stock in your online brokerage account and in your IRA.

- The #1 mistake people make when placing these trades (It could cost you thousands. But if you follow my strategy, you’ll NEVER make this mistake)

- How to set up these types of trades without risking a penny of your own capital on investing (I think you should try this if you’re a complete newbie).

- How anyone can initially set up these trades in less than 10 minutes a week… even if you’ve never invested before… And much, much more…

Once you watch these short videos, you’ll be ready to hit the ground running…

HOST/JOHN: And this video is 100% free when they join Rich Dad’s Weekly Cash Flow?

SCOTT: That’s correct.

And there’s more…

Because Robert and I have prepared a series of bonuses…

And these bonuses are really special because you’ll get insights from some of Robert’s top advisors.

HOST/JOHN: That’s great…

Can you explain each one now?

SCOTT: Sure…

So Robert and I believe in having multiple streams of income.

Which is why you’ll also get……

Surprise Bonus #2: Exclusive Video with Robert’s Personal Real Estate Advisor: Ken McElroy

Everyone knows, Robert has made millions in Real-Estate…

But what you probably didn't know is that he actually has a high-level advisor who keeps the pulse on the industry for him…

I’m talking about Ken McElroy…

In just 2 decades Ken has built an arsenal of over ten thousand properties and $800 million under management…

He’s one of America’s top expert on real estate investing with several best-selling books:

- The ABC’s of Real Estate Investing,

- The Advanced Guide to Real Estate Investing,

- The ABC’s of Property Management,

- And The Sleeping Giant

Robert asked him to personally prepare a video for you… Sharing the little-known secrets of how to Generate Income On Real Estate.

In fact, Ken has a message for the folks at home. Let’s check it out…

Hi Ken Mcelroy here. When Robert asked me to record this video for you… I didn’t think twice…

This is really exciting because inside this video you’ll Discover:

- My #1 way of finding little known deals that could generate extra cash e every month in rental income for you.

- The WORST mistake you can make in Real Estate if you want income… Miss this one move and you could have your money tied up for the next 5 years.

- The 3 little known side incomes that you could start collecting alongside rental income.

- And that’s in just the first 10 minutes… There’s much much more included.

I normally charge hundreds for a consultation on similar topics …

But this never-before released video is yours FREE when you join Rich Dad’s Weekly Cash Flow. Talk to you soon…

HOST/JOHN: Wow, Scott and Robert…

That’s great.

SCOTT: Yeah, and there’s more.

You see, soon you could be making so much extra cash that you’ll start thinking about how to KEEP more of it.

So we’re also going to give you…

Surprise Bonus #3: Exclusive Video with Robert’s Personal Tax Advisor: Tom Wheelwright, CPA…

Here’s the truth…

You might be paying too much in taxes…

There are a bunch of loopholes in the tax code that you can use to keep more of your hard earned money.

And there’s no one better to show you those loopholes than Tom.

He’s the best-selling author of Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes

In the last 30 years, he’s done everything from leading a team of thousands of CPAs at Ernst & Young’s National Tax Department in Washington, D.C…

To being the in-house tax advisor for a Fortune 1000 company…

To having his work published on every media site you can think of including:

The Wall Street Journal, The Washington Post, Forbes, Investor’s Business Daily, FOX & Friends, ABC News Radio, and much more…

He also sent a message for you. Let’s check it out…

Hi Tom Wheelwright here.

Robert asked me to share with you my top tips on how you can get back more money from the government every tax season.

And it’s my pleasure. So in this video I’ll show you…

- How to permanently lower your taxes by up to 10 - 40% …

- How to turn your auto commute into huge tax savings? Yes, this could work for some folks even if you’re just driving to the grocery store.

- A 100% legal way of paying zero taxes on investment returns. This is one of the secrets Robert uses to pay zero in taxes in some of his investments.

- And much more…

Clients pay me $95,000 for an annual wealth and tax strategy …

They pay that because I save them multiples of that.

But don’t worry. Even though This video covers similar concepts to my paid sessions, it’s yours FREE when you join Rich Dad’s Weekly Cash Flow.

HOST/JOHN: Robert, this is just incredible.

I’ve heard you saying before that “Anyone who wants to be rich needs to add Tom to their team.”

So how important is for everyday folks to be on top of their taxes?

ROBERT: Well, as you know the rich don't pay taxes and taxes are a person's largest single expense, because you went to school to get a job and learn nothing about the stock market or investing, so taxes are a part of everyone's real financial education. That's why Tom is my personal CPA. He has made me millions of dollars by saving me millions in taxes.

SCOTT: And John, we’re not done with the bonuses…

There’s more…

Because you’ll also get…

Surprise Bonus #4: Exclusive Video with Robert’s Personal Asset Protection Advisor: Garret Sutton

Garret is the bestselling author of The ABCs of Getting Out of Debt: Turn Bad Debt into Good Debt and Bad Credit into Good Credit.

Garrett’s even been Awarded Lifetime Achievement by America Top 100 Attorney which less than 1% of professionals in the United States will ever be a part of.

Simply put, you won’t find anyone better at showing you how to protect your assets.

Garret also sent us a message. Let’s check it out…

Hi Garret Sutton here and it’s a pleasure to be part of this project. Inside this video series, I’ll show actionable tricks like:

- The 1 simple move you can make to protect up to an unlimited amount of money in your real estate properties from greedy banks or lawyers. Yes, this includes your home. If you don’t do this, they could take your money and kick you out on the street in days…

- Or the little known loopholes lawyers expose during car accidents that could leave your retirement funds and bank account wide open for the taking… and 2 simple words you MUST tell your insurance company to protect your assets against these accidents.

- The obscure Wyoming law that allows you to protect every asset you own… no matter if it’s in a brokerage account, bank account, or even if it’s precious metals like gold and silver that you keep in a bank safe.

- And much more…

My clients have paid me up to $595 for similar information.

But this never-before released video is yours FREE when you join Rich Dad’s Weekly Cash Flow.

HOST/JOHN: Robert, you always talk about the importance of relying on a team of experts.

How much have these three advisors helped you?

ROBERT: Well, I wouldn't be a rich man without them because I was a C student in school.

Well, number one is my accountant.

You've got to have good numbers.

Number two is your attorney, you've got to protect your assets…

But number three is Ken McElroy. He's my expert on debt and the way you'll get rich in real estate is via debt.

So, Ken and I have over half a billion dollars in real estate and we couldn't have done that saving money.

So, Ken is my expert, when it comes to debt, how to borrow money, and how to make money from debt.

HOST/JOHN: This is incredible folks…

SCOTT: It really is John. Try calling any of those experts… and good luck getting a consultation.

These are very busy men. So for you to get their insights would be really special…

And on top of all of those videos…

We are going to give you each of their best-selling books for even more life changing advice…

Special Bonus #5: Garret Sutton’s The ABCs of Getting Out of Debt: Turn Bad Debt into Good Debt and Bad Credit into Good Credit.

If you’re struggling with debt, don’t worry.

Inside this book you’ll find out the quickest way to get out of debt and take control of your finances.

People are already raving on Amazon… people like Jeff who says…

Jeff

★★★★★ A must-read for people who are serious about getting control of their finances

Fantastic read full of a laundry list of resources for cleaning up credit, lowering interest rates, combating fraud and several other things.

Format: Kindle Edition | Verified Purchase

It’s yours FREE when you join…

Special Bonus Gift #6: Ken McElroy’s The ABC of Real Estate Investing: The Secrets of Finding Hidden Profits Most Investors Miss

This book alone can be life-changing… just listen to this review on Amazon… Linda says…

Linda

★★★★★ This book changed my life!

This book changed my life! I hope to start my own investment company buying apartments. This book will be referred to very often.

This book is also yours FREE once you join us.

Special Bonus #7: Tom Wheelwright’s Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes

Look, Tom Wheelwright somehow make Taxes interesting and fun.

He is so passionate and knowledgeable about what he does it’s just amazing. That’s why you’ll find reviews like this on Amazon… Amber Z. says…

Amber Z.

★★★★★ Relates to New Tax Laws!

Great book that explains taxes in an interesting way! It's a quick read, full of tax strategies. It's also a novel way of looking at taxes - as incentives offered by the government to anyone who wants to save tax money by doing what the government wants. The gov't bribes you with lower taxes to do what they want. You don't have to be rich to save taxes.

Format: Kindle Edition | Verified Purchase

This is also yours FREE when you join us today.

HOST/JOHN: Okay Wow… That is a ton of value you guys are giving away…

In fact, I think it’s a good idea for me to recap…

So Here’s Everything You’ll Get Once You Join These Real Americans Who’ve Already Cashed In:

- A one year subscription to Rich Dad’s Weekly Cash Flow Research Service with a New recommendation EVERY Week: Every week, Scott will tell you about a new trade idea that could put money in your pocket. You’ll get 52 plays in a year… along with all of his market research and analysis… starting with your very first one tomorrow (Value: $5,000)

- Weekly commentary from Robert and Scott on what’s happening in the investment world.

- Urgent Anytime Profit-Taking Alerts: When it’s finally time to take gains, they’ll blast out an urgent email – telling you exactly what to sell, for what potential gain. It couldn’t be easier.

- Monthly Model Portfolio Updates: Every month, Robert and Scott will send you a recap of the open trades and what to do with them. (Value: $399)

- Surprise Bonus #1: FREE 10-part video series masterclass the Cash Flow Zone Academy to help you get started right away. (Value: $4,999)

- Surprise Bonus #2: Exclusive Video with Robert’s Personal Real Estate Advisor: Ken McElroy (Value: $1,999)

- Surprise Bonus #3: Exclusive Video with Robert’s Personal Tax Advisor: Tom Wheelwright, CPA… (Value: $1,999)

- Surprise Bonus #4: Exclusive Video with Robert’s Personal Asset Protection Advisor: Garret Sutton (Value: $1,999)

- Special Bonus #5: Garret Sutton’s The ABCs of Getting Out of Debt: Turn Bad Debt into Good Debt and Bad Credit into Good Credit. (Value: $18.95)

- Special Bonus #6: Ken McElroy’s The ABC of Real Estate Investing: The Secrets of Finding Hidden Profits Most Investors Miss (Value: $13.95)

- Special Bonus #7: Tom Wheelwright’s Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes (Value: $12.69)

That’s a Total Value of $16,440.

So is that the cost of membership?

SCOTT: Look, it’s not cheap because we’ve committed a lot of resources to this project for the last year and a half…

Our accounting records show we’ve spent over $3 million when your account for everything involved in our research, overhead, marketing, employees, and more…But if we charged the full value of $16,000… it would be out of reach for a lot of folks.

And that’s not what we want.

And That’s Why Subscription to Rich Dad’s Weekly Cash Flow Doesn’t Cost $17,000.

It Retails For $5,000 a Year.

HOST/JOHN: And Scott, that’s already a bargain… and I say that because I’ve seen some extraordinary notes you’ve received from a few members…

Let me share some of this…

People like Dean Kelly, a commercial Roofing Professional – he told us:

Dean Kelly

“I’ve made $10,760 in just over a month! I’m now recommending this strategy to my son.”

Disclaimer: Dean didn’t tell us, but we estimate that he started with $101,700 to make $10,760 in a little over one month.

Hugh G., a Real Estate Agent in Mississippi:

Hugh G

Mississippi

“It’s a solid, conservative way to generate positive cash flow and profit. I’ve made $12,800 and I’m expecting another $3,683 soon!”

Disclaimer: Hugh didn’t tell us, but we estimate that he started with $98,159 to make $12,800 in a little over three months.

Cameron Hale from Texas made $44,619 in under 6 months. He says…

Cameron Hale

Texas

“I very much like the concept [of this strategy]…”

Disclaimer: Cameron didn’t tell us, but we estimate that he started with $998,187 to make $44,619 in under 6 months.

I mean… these people made multiples of the cost of the service.

So I can see why depending on your situation $5,000 is well worth it.

SCOTT: Well, it really is, John.

But I’ll tell you what…

Robert and I both come from middle class…

And we know this could really be life-changing…

So we don’t want price to be an issue…

That’s why today…

Rich Dad’s Weekly Cash Flow Won’t Cost $5,000

We’ve decided to offer a $3000 discount to anyone who acts today.

So only through this page, a subscription is only $1,995 today.

We’re confident you’ll be able to make this back in no time… just like many of our members already have.

And we’ll even back that up with…

A $10,500 Special Guarantee Package.

HOST/JOHN: A guarantee package?

SCOTT: Yeah, Here’s how it works…

We’ll basically guarantee that you’ll be 100% happy with our service.

If you don’t feel like this service is worth at least 10 times the cost of subscription, just give us a call and we’ll give you a special guarantee package as a gift.

This package includes…

In total, that’s a $10,500 guarantee package.

If we don’t perform, just call us and we’ll give it to you… FREE. No questions asked.

In other words, we’re fully covering the cost of your subscription.

That’s how confident Robert and I are on our strategy…

HOST/JOHN: that’s incredible Scott.

I mean, that extra year you’re giving away… that alone has a $5,000 value.

And Remember, Scott is getting ready to tell you about another trade opportunity as early as tomorrow

Then, there will be another opportunity every week…

Now, before we end the show…

I want to do a Q&A because we covered a lot of ground here…

So I want to make sure we address some of the most common questions. Is that ok with you guys?

SCOTT: Sure, Let’s do it.

HOST/JOHN: OK, here you go…

Let’s start with this question that’s been on the back of my mind…

Question #1: What happens if the stock doesn’t end in the “trap”?

SCOTT: We showed you today how so far, we’ve had an 87% success rate.

So it’s not 100%.

There’s no such thing as a guaranteed trade in the investment world.

Anyone who tells you they’ve found a perfect strategy… they’re full of it.

The key is to manage the risk.

That’s what we’ll be doing in Rich Dad’s Weekly Cash Flow.

Once we send out an alert with one of these trade ideas, we’ll watch it like a hawk.

As I mentioned before, we don’t want the trade to move outside the “Trap”.

So as soon as that starts to happen, we make some adjustments to the trade to reduce our risk.

It can get a bit complicated, so I won’t cover the details here…

Instead I’ll explain this in the video series which I encourage you to watch as soon as you join us…

But for now, you should know the pros on Wall Street call this adjustment “delta hedging.”

You’re basically making an adjustment to the trade to reduce your risk.

So let’s say a trade is going wrong and it moved outside the “Trap”.

If you do nothing, you’ll lose money.

But with delta hedging, we can reduce the loss…

You’ll need to invest a little more, but the nice thing is that in some lucky cases you can even turn a losing trade into a winning one.

HOST/JOHN: Can you give us an example?

SCOTT: Sure…

Earlier I told you about one of our trades on SPY, an ETF that tracks the S&P 500 index…

That trade was actually a loser.

This is what it looked like…

As you can see, it moved outside the trap, so if we did nothing, people would have lost money…

But instead we just moved the upper boundary of the Trap like this…

See now it ended in our trap…

HOST/JOHN: Wow so you turned that loser into a winner just like that!

But can you only move it up… what if the stock falls below the bottom of the trap?

SCOTT: Good question, so we move the boundaries of the trap up, down, and we can even extend the trap sideways…

Of course, even with these adjustments you can’t completely eliminate all losses. There’s no such thing in the investment world.

So, when a trade goes wrong, you could still lose your investment.

That’s why I tell you not to invest more than you can afford to lose.

But just to show you how relatively safe my strategy can be compared to others …

In 2008, most people lost everything in the markets, right?

I mean, lots of stocks crashed 80%, 90% and some even went to zero.

That could be some or all of your savings for retirement…

But, had you invested in an index that uses this cash flow zone strategy in 2008, you’d have been down about 4% of your money.

I mean, this kind of loss will never bankrupt anyone.

So we’re talking about a 4% loss during the biggest financial crisis of our generation.

This is so impressive that Barons even wrote an article about it.

HOST/JOHN: Ok, so I think I understand… you can make adjustments to the trade to greatly reduce your risk.

Question #2: “How much money do I need to get started?”

SCOTT: It’s all about being smart with your position sizing. You know that you're doing a great job with your position sizing when you can wake up one morning, see one of your positions having gone bankrupt on you overnight, and you look at it and say, "Huh. Well, that's not really what I hoped to have happen with that trade, but it doesn't really affect my overall rates of return because it's such a small portion of my overall portfolio."

We recommend people have at least $20k in their account to get the best of this strategy if they choose to participate…

HOST/JOHN: Wow that’s a lot less than what I was expecting.

And just to be 100% clear… you’re not talking about 20K on a single play, right?

SCOTT: No, not at all…

I’m talking about the total size of your trading account.

If you have at least 20k, this will work best for you.

The average minimum capital required per play in my track record is $1,387.

That will give you some room to place this kind of trade in different stocks at the same time.

HOST/JOHN: Ah… ok I see. So what you’re saying is you’ll want 20k to feel safe because you’ll have plenty left over after each trade…

SCOTT: Yup, you’ve got it…

HOST/JOHN: Ok, here’s another question…

After someone watches your video masterclass and understands how everything works…

Question #3: How much time does this require?

SCOTT: I’d say 10 to 20 minutes a week…

You’ll need a few minutes to read our alerts and market analysis… watch my video walk though… … and if you decide to participate… it would take a few minutes to set up the trade.

But this is definitely not like day trading, where you have to be in front of your computer all day.

That’s why we got a note from one of our members, Shane Mayer from New Orleans… She said:

Shane Mayer

New Orleans

“I made $1,830.66 [from the ASDK trade]. This is a great way to make some extra money for any number of reasons and with a little adjusting of your daily routine can be done whether you are retired or working full/part time.”

Disclaimer: Our reader didn’t tell us, but we estimate they would have had to put an investment of $2,905 to make $1,830.66 in 69 days.

HOST/JOHN: So let’s wrap this up…

I’m simply blown away by the results of this project…

As you’ve seen today, real hard-working Americans just like you have used this technique to make a ton of money from a single trade.

Since launching this project, Scott has shared over 66 trade ideas with his readers… along with all of his market research and analysis… and so far with a win rate of 85%…

Which is unheard of.

That’s like… for every 20 opportunities, 17 have made money.

Today they’re offering a package with a total value of about $16,000…

But membership to this research service is only $1,995…

That’s 52 chances for you to put money in your pocket.

And they’re making this a no-brainer by offering their $10,500 guarantee package.

So now it’s time for your decision…

If you want to be a part of the Real Americans Income Project just click the button below to take the next step…

You’ll be taken to a page like this…

Where you can review everything and decide if this is right for you.

NEXT STEP »If you prefer to speak to someone, you can also call 855-303-4012.

But I’m gonna warn you that the lines will be busy… and you might have to wait a long time

Remember, tomorrow Scott will send an email with his research to members telling them about another trade idea that could put money in your pocket.

This strategy is already changing the lives of hard working people all across America…

You could be the next success story… starting tomorrow…

Then you’ll have 52 chances to collect money over the next year.

Scott, do you really find a new opportunity every week?

SCOTT: Absolutely.

You can set up trades to essentially “trap” stocks over and over again…

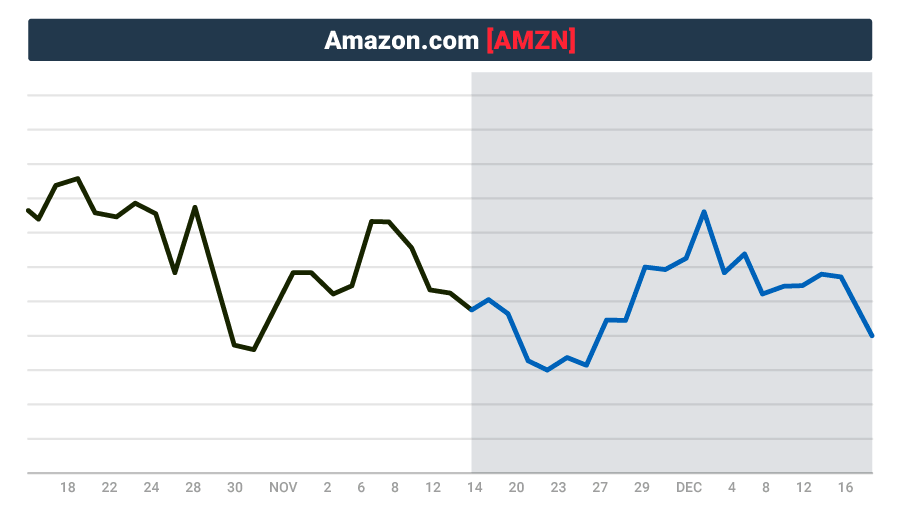

Like with this Trap on Amazon’s stock. Share ended up a little lower than when it started…

But people like Harold Masterson who “Trapped” the stock didn’t lose a cent…

Instead Harold made $1,763 and he said he’s using the money he makes from this strategy to “pay for living expenses”

Disclaimer: Our reader didn’t tell us, but we estimate they would have had to put an investment of $22,037 to make that much of a return in 30 days.

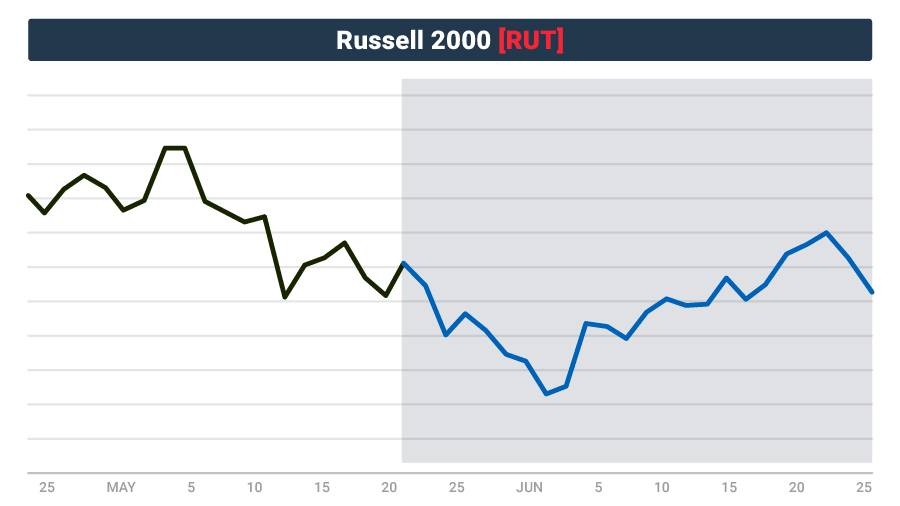

And there’s the Russel 2000 Index which also went sideways…

But Frank Ruth made this trade and walked away with $1,900…

He said:

Frank Ruth

“I’m going to keep investing. It’s really interesting to be able to learn with Robert. I learned a lot and improved my life.”

Disclaimer: Our reader didn’t tell us, but we estimate they would have had to put an investment of $13,629 to make $1,900 30 days.

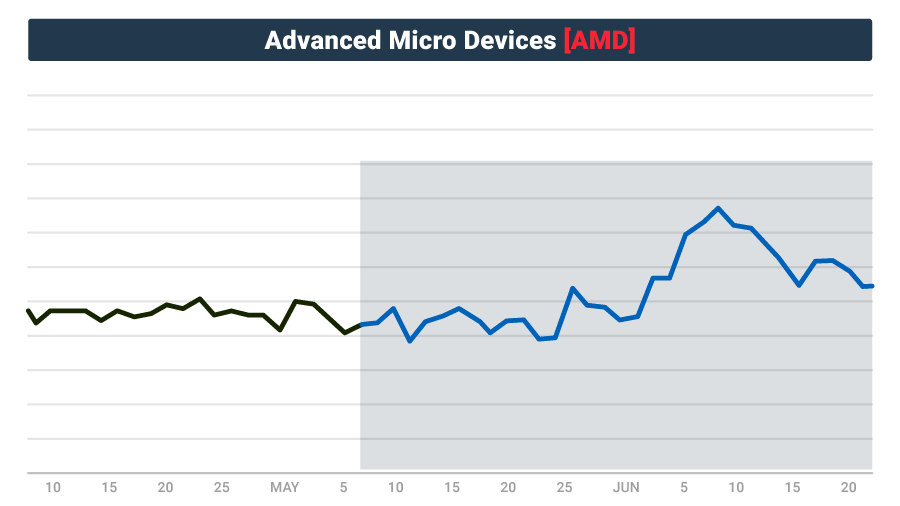

And the same thing with Advanced Micro Devices…

Though it went up about $2 or $3 that’s nothing compared to what Jim Rostrum from Chicago made.

He cashed out of this trade with $2,581.71 and sent us this note:

Jim Rostrum

Chicago

“Who would not like to make twenty-five trades with no losses?”

Disclaimer: Our reader didn’t tell us, but we estimate they would have had to put an investment of $19,425 to make $2,581.71 in 44 days

Now I don’t want anyone thinking past performance guarantees future results, but what do you think about that John?

HOST/JOHN: I think it’s great.

Now, for you watching at home, click the “Next step” button that you see on your screen to get started…

NEXT STEP »Hitting this button does not obligate you to anything. You’ll be taken to another page where you can review everything.

Ok, so let’s move on…here’s another question…and Robert, this question is for you…

Question #4: The stock market has rebounded quickly from the recent pandemic panic. Shouldn’t people just buy and hold stocks?

ROBERT: Absolutely not.

I'll say it again, the pandemic changed the world forever.

And I'm primarily a real estate guy. Real estate's coming back.

These big shopping centers and all that, but they're going to bring everybody down.

The cruise lines will bring people down. Airlines will bring people down.

That's why buy, hold and pray which a financial planner tells you to do, it's really bad advice.

And that's why I'm here to endorse my friend, Scott here, and the students that went before him.

You'd better find the formula that works for you.

Always remember this: the S&P 500, they all say to buy that, that's 475 losers.

That's not Scott's formula, you better find the winners.

SCOTT: John, just to add to what Robert is saying…

Even in the bull market, if you’re just buying and holding you can still lose money.

For example, did you know that In the last 2 years alone… about 60% of all stocks in the U.S. market have actually lost money.

HOST/JOHN: Really? Wow.

SCOTT: Yep.

And it gets worse…

Most stocks would have lost you about 40% of your money on average…

That’s like taking the average IRA which is around $100,000

And cutting $40,000 right off the top… and throwing it right down the toilet.

And that’s not even the worst of it…

Many of the stocks have actually lost almost 100% of their value…

Meaning, if you are just like every other trader… Odds are you are going to lose money while buying and holding stocks.

HOST/JOHN: Alright, Jeez that is frightening…

Sounds like you have to be a really good stock picker.

Looks like the odds are stacked against folks who are simply buying and holding stocks.

Especially when you compare that to your 85%-win rate. Sounds like setting up a “Trap” seems like the way to go.

So for you watching at home, if you’d like to gain access to this high-probability strategy, click below to get started.

Ok, Let’s move on to… Scott I’ve got one last question for you…

Question #5: What if I’ve never done this type of trade before?

SCOTT: This is a question that I get a lot…

Because let’s be honest… this is a brand-new way to make money for most people.

It can seem intimidating at first.

But here’s the thing…

Like I mentioned before…

Every week with that email we send to readers…

Not only do they get expert guidance and wisdom from Robert…

But they also will get a detailed video from me…

And you’ll see exactly what my computer screen looks like…

This way you can follow along with me step by step.

And again… if there’s ever any confusion there’s also the special bonus 10-part video series which breaks down everything you need to know about this strategy.

So I’m confident any beginner will be able to get going on their first try.

HOST/JOHN: Ok, I think we’re running out of time.

So click the “Next step” button that you see on your screen to get started…

NEXT STEP »Hitting this button does not obligate you to anything.

You’ll just be directed to another page, where you can review all the details of this special offer.

Robert and Scott, thank you so much for being here today.

SCOTT: My pleasure.

ROBERT: My pleasure.

HOST/JOHN: Thank you all and God bless.

Robert Kiyosaki & Scott Stewart

Aubust 2020