Name and Ticker Symbol Will be Revealed Inside This Broadcast.

TRUMP’S

SECRET WEAPON

IN THE A.I. RACE

In Just 4 Months, China Could Pull The Plug on America’s

A.I. Future - Unless One Tiny U.S. Firm Stops Them.

Name and Ticker Symbol Will be Revealed Inside This Broadcast.

In Just 4 Months, China Could Pull The Plug on America’s

A.I. Future - Unless One Tiny U.S. Firm Stops Them.

Enrique Abeyta

Time is running out on America’s A.I. revolution.

We’re racing against the clock...

And if we miss this narrow window…

The most powerful technology on Earth could slip into enemy hands.

The consequences?

Staggering.

I know that sounds extreme.

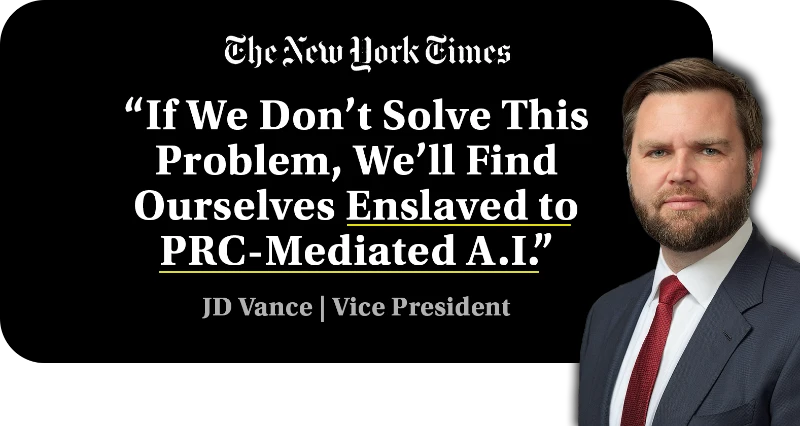

Don’t just take my word for it.

Vice President J.D. Vance recently warned:

In plain English: China could soon control the backbone of our digital future.

Imagine President Xi Jinping with his finger over a global kill switch.

That’s the reality of what we’re facing.

And yet, most U.S. CEOs are too busy celebrating quarterly earnings…

Too focused on short-term stock pops…

To see the chokehold tightening just offshore.

They’re missing the forest—and the fire burning through it.

Here’s the truth most aren’t willing to say…

China has an absolute stranglehold on what I call “Intelligence Minerals”…

These are the raw materials that make artificial intelligence possible.

Cut them off, and the dominoes start to fall:

And without these same minerals, Lockheed and other defense firms can’t build engines, drones, or autonomous weapons.

One choke point.

One decision in Beijing.

And the entire A.I. stack — from Wall Street to Silicon Valley to the Pentagon — shuts down.

For years, China’s near-monopoly on intelligence minerals has been enough to supply not just the U.S., but Japan, Europe, and beyond.

Now the world has changed.

Tariffs are rising.

Tensions are flaring.

And for the first time, Beijing has threatened to cut us off.

If that happens?

It could’ve been a death sentence.

Diplomatic code for: “We’ll cut you off when it hurts most.”

The really scary thing is that deal happened 2 months ago.

We only have until December to find a solution.

Our AI infrastructure—and the chips that power everything from ChatGPT to fighter jets—rests on a fragile foundation: these critical minerals.

Without them, both innovation and national security grind to a halt.

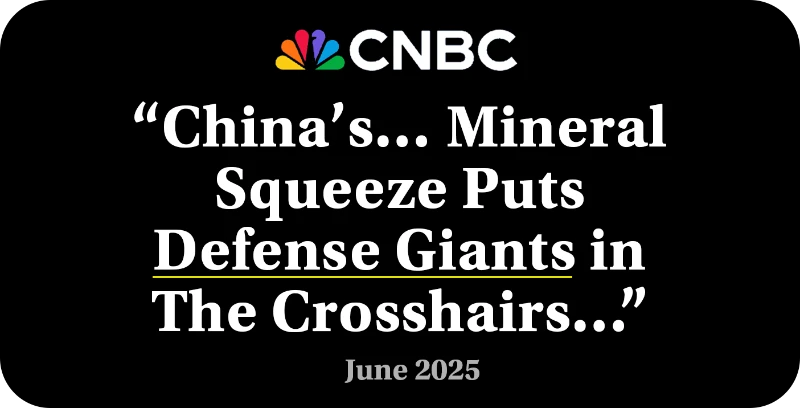

As CNBC’s Sam Meredith put it,

Elon Musk has admitted the shortage is already impacting his ability to build next generation technologies…

The New York Times captured it bluntly:

And U.S. Representative Young Kim, Chair of the House Foreign Affairs East Asia Subcommittee calls this a chokehold:

But it’s not just Big Tech at risk.

92% of all Fortune 500 companies are using AI in their business…

Along with hundreds of U.S. military projects.

Make no mistake—we’re staring down a technological cliff.

But there’s a bright spot…

And it ties back to one of President Trump’s most important decisions.

Just weeks ago, he gave an American company a historic mission:

Deliver Intelligence Minerals at scale — without a single ounce from China.

To make sure it’s successful…

This isn’t a bailout.

It’s a 9-figure investment.

And Trump’s not alone…

Days after his administration took its stake—a tech giant followed suit—with hundreds of millions in private funding.

So stay tuned…

Hi, I’m Enrique Abeyta.

I went from being homeless as a kid… to the Ivy League… to managing billions on Wall Street.

I co-founded one hedge fund, and helped start two more… managed nearly $4 billion…

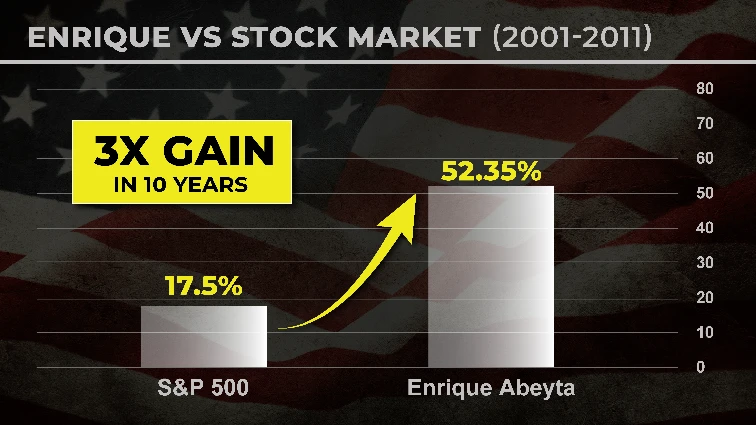

…and from 2001 to 2011… a period that included the dot-com crash and housing meltdown, I delivered returns 3X the S&P 500 — ranking in the top 3% of money managers worldwide.

And my most recent model portfolio win rate just hit 85% — proving these strategies still work today.

Since leaving hedge funds, I’ve helped everyday investors tap the same kinds of opportunities across a wide array of strategies and services.

With my win rate overall… you could probably say my readers do well if they’re following everything I put out.

From small accounts to large, the principles are the same… and the results can be life-changing.

Even when I stepped back to focus on raising my three kids, I couldn’t stay away from the markets.

During the Covid crash, I told readers it was the best buying opportunity of the decade — just one day after the market bottom.

Less than a year later, every stock my team and I picked was up double- or triple-digits.

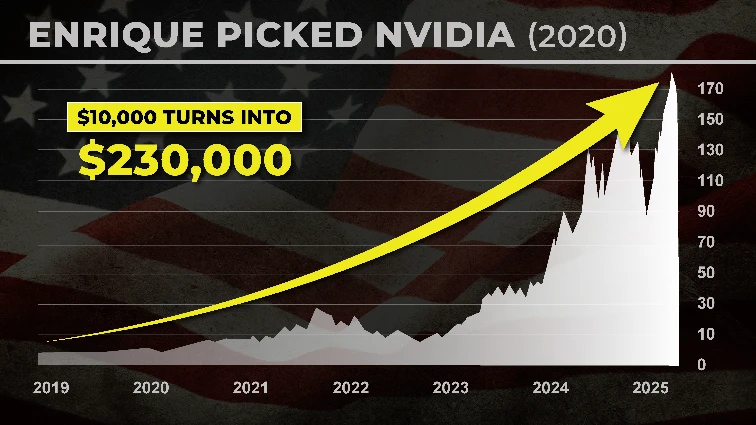

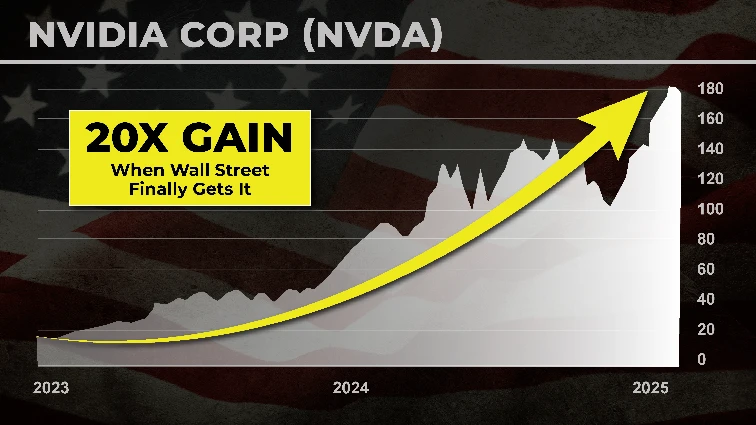

And in February 2020, when almost no one was talking about A.I., my team and I told my readers to buy Nvidia — predicting its sales would triple.

Today, Nvidia controls 92% of the A.I. chip market…

Microsoft, Amazon, Google, Meta, Oracle, and Tesla have all spent billions buying Nvidia chips.

That boom minted over 500,000 new millionaires.

If you missed it, don’t miss this.

Right now, nothing is more urgent than securing Intelligence Minerals for American A.I.

And the Pentagon-backed company I’ll show you could be the only thing standing between America and an A.I. crisis.

I’ll share that name with you before the end of this broadcast.

If I’m right, investors could double their money in six months—maybe more—while the market scrambles to catch up.

And that’s only one of three plays I’ll tell you about today—each tied to the biggest tech arms race since the dawn of the internet.

Now you’ve probably heard about the “backbone” of AI:

None of this could exist without one thing—which I call “Intelligence Minerals”—rare, high-performance materials with no known substitutes.

There are 22 in total.

They—along with some others—exist on a US Government list labeled “Critical Materials.” Just think of them as the endangered species of the resource world.

Without these minerals…?

All the software in the world is useless. And every chip factory and data center would grind to a halt.

That’s why the U.S. military stockpiles over $1.2 billion worth in secure sites in Texas and Pennsylvania.

And why China has spent two decades cornering the market.

But recently, something changed…

In retaliation for tariffs…

Beijing has threatened to ban the export of key minerals.

By the end of the year?

We could be cut off.

So why does this matter—and how could it affect you in the weeks ahead?

Here’s a quick demonstration to show how powerful — and misunderstood — these materials are.

This is just an ordinary fridge magnet. Weak. Barely holds a grocery list.

Now, this is a neodymium magnet. They’re capable of holding hundreds or even thousands of times their own weight, and over 10 times stronger than ceramic magnets of the same size.

Neodymium is one of the Intelligence Minerals vital to AI.

It powers EV motors, Nvidia cooling fans, and missile guidance.

Without intelligence minerals like neodymium?

There’s no A.I.

We have just months before our world changes — unless extreme action is taken.

And for the first time in U.S. history, we’re seeing a President willing to take those kinds of extreme measures.

Trump has already shown he’ll use unprecedented levers of power—tariffs, executive orders, even outright seizures of supply chains—when national security is at stake.

And this time, his hand-selected solution to combat China’s stranglehold could secure America’s future in artificial intelligence.

Because A.I. is the most valuable — and strategically important — tech on Earth.

And Intelligence Minerals are its oxygen:

No neodymium or dysprosium?

No gallium or germanium?

No terbium?

He wasn’t joking.

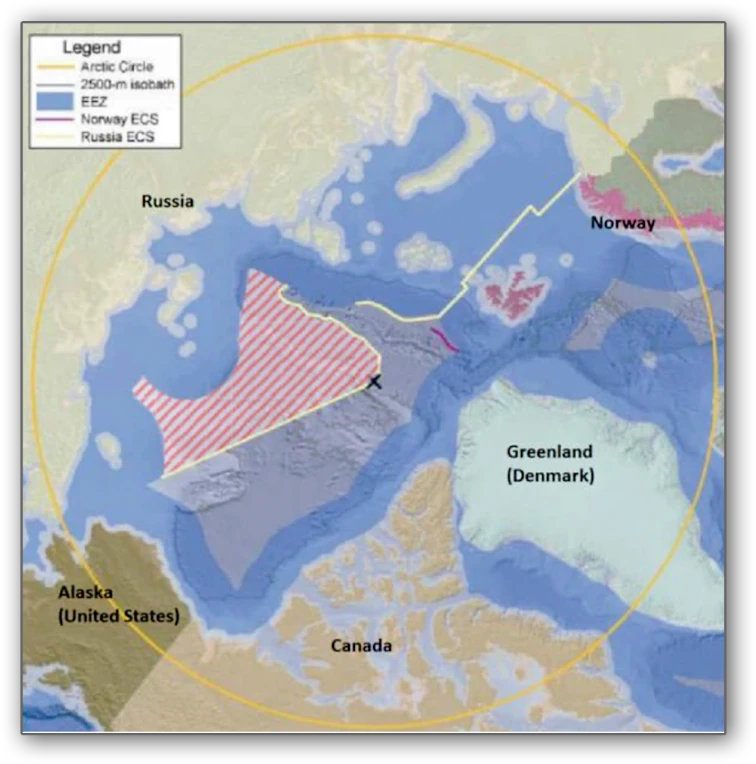

In 2019 he even offered to buy it.

Why?

Some estimates say Greenland holds nearly 20% of the world’s known rare earths (which comprise the bulk of the Intelligence Minerals).

Denmark — which governs Greenland — said no.

That “no” lit a quiet cold war that’s now heating up.

After the refusal, U.S. companies partnered with Greenland’s government.

China funded new “research stations” on the island.

Sounds harmless.

But we’ve seen this move before.

In 1943, the U.S. used Greenland to hunt U-boats.

The Pentagon soon saw its true value: location + resources.

By 1959, the U.S. planned Project Iceworm — a network under the ice to hide hundreds of missiles.

They even built underground rooms, shops, even a small reactor.

Denmark was told they were “research stations.”

Today, China uses the same label.

Russia joined too…

In 2007 it mapped the seabed and claimed links to the Siberian shelf—a bid for future mining rights under international law.

As China took over rare earth markets in the 2000s (by the way—95% of the “Intelligence Minerals” are rare earth elements) Greenland turned critical…

In 2016, Beijing moved on Greenland’s airports.

Denmark blocked the deal, fearing control of airfields would lead to control of mines.

U.S. officials warned those airports could be dual-use.

Three powers now circle Greenland, each with a different playbook.

As the Journal recently reported, tensions there are “simmering.”

Trump is opening talks on intelligence minerals in the Congo — while China, after years and billions invested, holds a major share of the region’s output.

China is also pushing into space, scouting the Moon for future resources…

And moving to dominate the oceans — the largest untapped resource zone on Earth.

While Trump has answered back with his own executive order to extract minerals from under the sea.

The war is on.

It’s chess at the highest level—land, sea, and outer space.

That law lets Washington say, “we need it — build it now.”

It was a boon for contractors in the Korean War.

A 1951 Senate report shows the top ten firms took 40% of prime defense dollars.

How many became household names—and huge wins for early investors?

Could Trump’s hand-selected company — fresh off a DoD investment — be spoken of the same way years from now?

Bottom line: Washington is finally acting after decades of neglect.

They’re buying stakes in key producers, signing decade-long supply deals, and pouring hundreds of millions into mining and processing.

It’s a Cold War–style push.

But building a domestic supply chain for these minerals usually takes ten years — and we have less than 4 months.

President Trump has doubled down — faster permits, price floors to keep U.S. producers alive, and priority status for defense minerals.

Even Jamie Dimon is concerned.

Recently, he said:

The good news: America is taking massive steps in that direction…

And over time, these steps can make us an AI superpower.

Most people don’t realize this, but America has more intelligence minerals than Greenland, by many estimates.

Yet, foolishly—starting with Carter in the 70s and then Clinton in the 90s—we locked it down with reams of regulation and red tape.

Now—finally—Trump has set it all free.

And while it may seem impossible…

We’ve been here before.

In fact, Trump is taking a page out of Reagan’s own playbook.

And he’s not just taking it—he’s copying it move for move.

You see, in the 1980s, Japan controlled almost the entire global memory chip market.

I’m talking 90%.

And American companies?

Intel, Texas Instruments, Micron — they were getting crushed.

People in Washington thought the U.S. might actually lose its entire semiconductor industry.

Sound familiar?

Here’s what happened…

First, he slapped tariffs on Japanese chips.

Then, in 1986, he cut a deal with Japan that forced them to stop dumping cheap chips on the market and to actually open their doors to American companies.

And when Japan tried to play games and ignore the deal?

Reagan called their bluff and slapped them with sanctions.

At the same time, the Pentagon stepped in…

DARPA and the Department of Defense knew semiconductors weren’t just about consumer tech — they were about national security.

So they guaranteed contracts for U.S. chipmakers. That way, companies like Intel and Micron knew they had a base of demand while they rebuilt.

Then came the big move — SEMATECH. A government-backed research consortium launched in 1987.

Washington matched every dollar U.S. chipmakers put in…

Intel, IBM, Micron, the biggest names all joined.

And together, they used that money to claw back America’s edge in manufacturing and design.

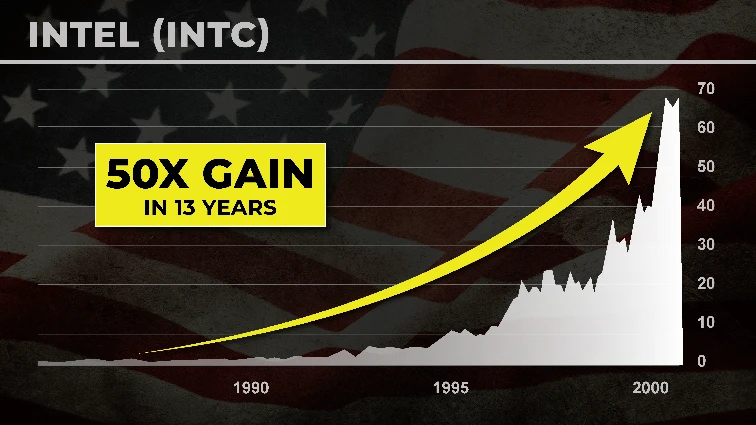

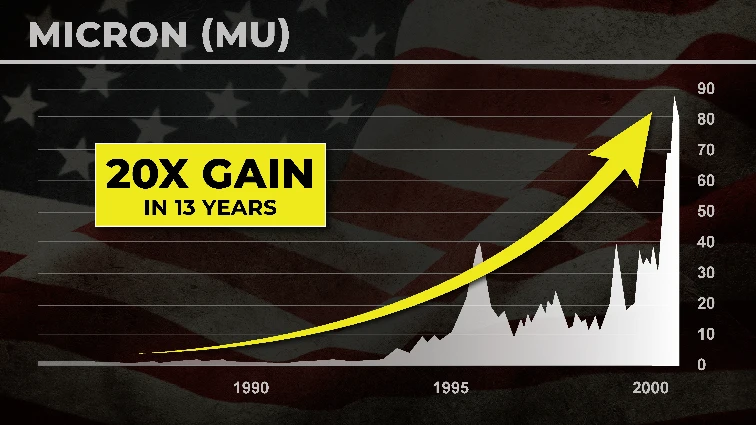

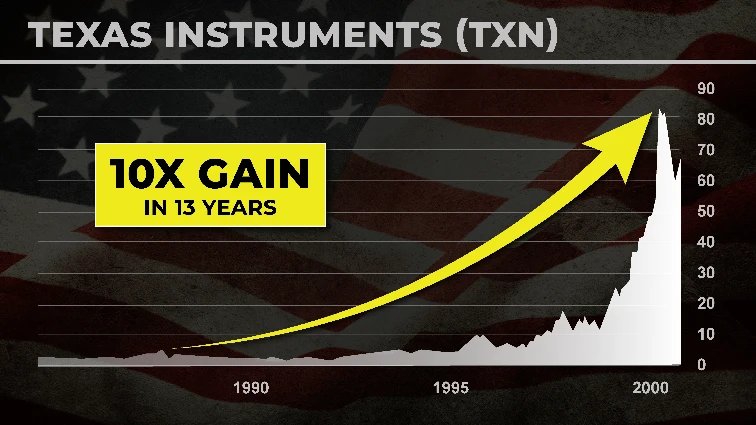

The result?

Intel pivoted from memory to microprocessors — and became a giant. Micron scaled up.

Texas Instruments reinvented itself around defense and signal processing.

And America’s leadership in semiconductors was restored.

But here’s the part most people don’t realize…

The shareholders who stuck it out — who kept their money in those beaten-down companies — saw life-changing gains.

Intel went up nearly 10x by the mid-1990s… and more than 50x if you held through the dot-com boom.

Micron surged nearly 20x in the same period.

And Texas Instruments climbed from the low teens to nearly $100 — almost a 10-bagger.

All because Washington recognized the stakes… and backed our innovators when it mattered most.

And now?

We’re standing at the exact same kind of turning point.

Only this time, the stakes are far higher.

Back then, it was memory chips.

Today, it’s the raw ingredients of artificial intelligence itself — the “intelligence minerals” that power everything from Nvidia’s GPUs to America’s most advanced fighter jets.

If Washington fails to back our innovators now, China could seize control of the entire future of AI.

But if the U.S. rallies like it did in the 1980s?

Then the companies on the right side of this fight — and the shareholders who bet on them now — could be looking at another wave of fortune-building returns.

And that’s where the opportunity lies.

Because Trump has authorized 9 figures of support for one business…

This isn’t a prediction.

It’s already happening.

The Pentagon is its biggest customer.

And Apple just signed a $300 million–plus deal with them.

Here’s why that matters…

This company sits on one of the richest deposits of Intelligence Minerals in the entire Western Hemisphere.

Back in the Cold War, it supplied almost all of America’s needs.

Then… thanks to another Washington blunder, the mine sat idle for decades — leaving the door wide open for China’s takeover.

Now, with Beijing squeezing supply and prices spiking, it’s back online…

Fully modernized…

And directly funded by the U.S. Department of Defense.

Earlier this year, the Pentagon signed a nine-figure contract that guarantees this company steady revenue for years — no matter what happens to prices.

The company’s name is MP Materials. That’s “M” as in Mountain. P as in “Pass.”

MP Materials. The ticker symbol is MP.

The Government even took an equity stake in MP— the first move of its kind since Washington’s wartime scramble to secure raw materials in World War II.

Why would they do that?

Because MP Materials is sitting on the single richest deposit of Intelligence Minerals in North America.

From that one site, the company controls nearly 1.9 million metric tons of reserves.

But here’s the catch…

That math only holds if demand stays flat.

And we both know it won’t.

AI data centers, EVs, drones, fighter jets — all of them require more rare earths every single year.

Which means MP, as powerful as it is, can’t carry the entire load alone.

Still — what it produces right now is critical.

From this one deposit, MP can supply nearly most of the critical intelligence minerals America needs for its high-tech future.

I’d say that makes MP the Pentagon’s flagship.

A near-complete security package for U.S. supply chains.

Its Pentagon contracts have topped $100 million.

And its corporate contract with Apple is worth even more…

And here’s the kicker…

Even after surging more than 40% off its 2024 lows, MP is still priced like a run-of-the-mill miner.

Because Washington is moving now — locking in contracts and funding ahead of China’s December deadline for export restrictions on strategic minerals.

The Pentagon’s long-term goal is a secure, U.S.-based rare earth supply chain by 2027…

But the first wave of orders and market recognition will hit much sooner, as buyers scramble to secure supply before the cutoff.

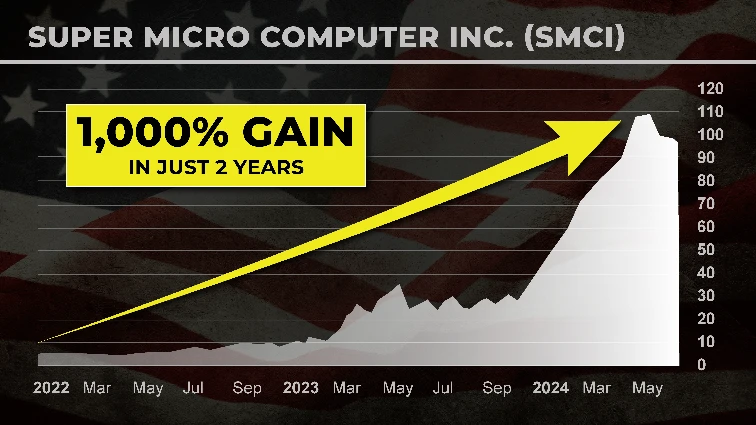

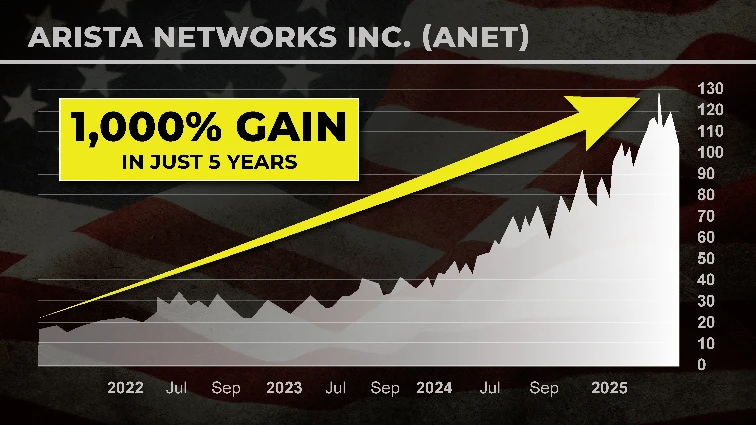

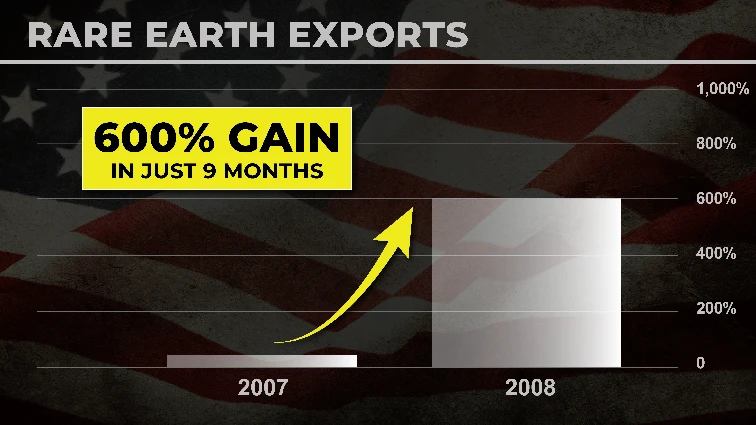

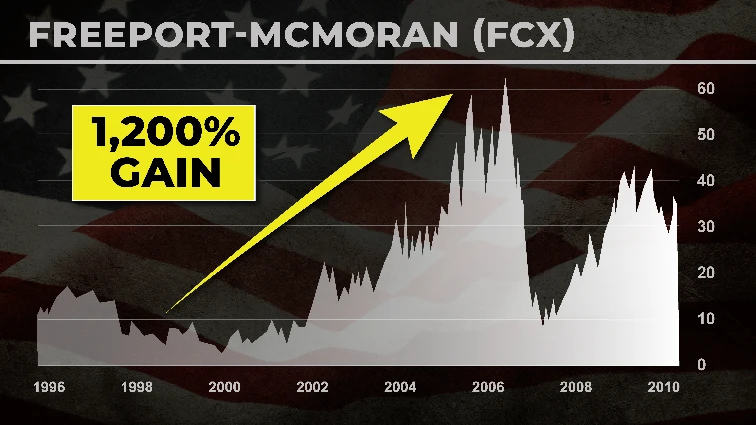

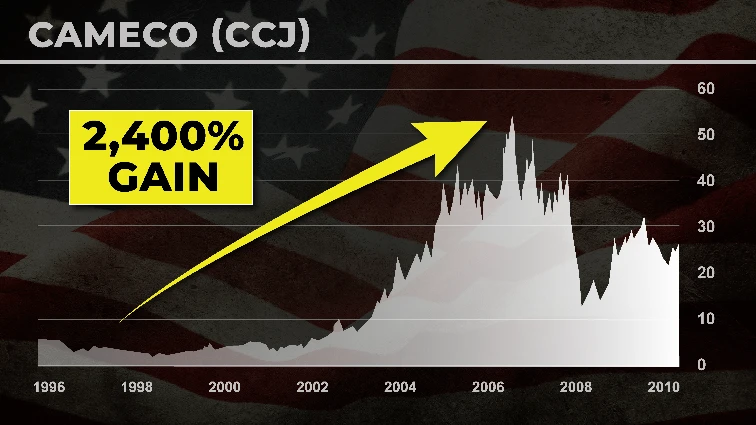

And history shows that’s when the biggest moves happen:

I believe we’re on the verge of the same kind of move today.

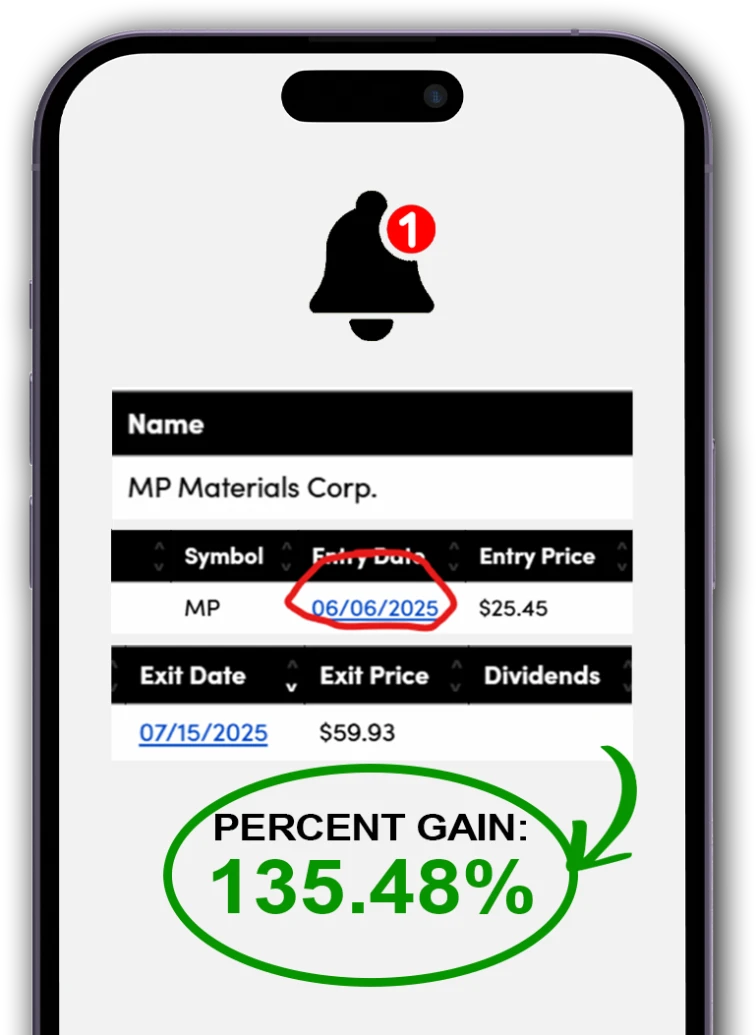

My subscribers have already had a chance to make as much as 135% on MP Materials.

I recommended they buy shares in the company on June 6th—a full month before the announcement was released.

No insider secrets. Just rigorous analysis of the government’s own moves.

And I believe MP still has much further to run… which is why I’ve urged my subscribers to continue to hold some of their position.

That’s why I put all my research, analysis, and step-by-step instructions into a new Special Report I call:

Pentagon-Backed, American Investing Miracles.

Inside, you’ll find:

You’ll see exactly why I believe MP could go down as one of the decade’s top-performing stocks.

Now, nothing is ever foolproof. If anyone tells you otherwise, run far away. That’s why I always say: never put in more than you can comfortably afford to lose. That said, when you weigh the downside against the potential upside, I believe the opportunity here is hard to ignore.

And here’s what most people miss: this story doesn’t end with MP.

Because while I believe MP is the Pentagon’s chosen flagship, I don’t expect it to be the only winner.

Sometimes, speed matters even more.

Have you heard of Spindletop?

In 1901, a drill bit struck oil in East Texas with such force it shot 100 feet into the sky.

That strike didn’t just make a few men rich. It kicked off the Texas Oil Boom.

It birthed giants like Texaco and Gulf Oil. It changed America’s future.

Now history is rhyming.

Only this time, the “gusher” isn’t oil.

It’s Intelligence Minerals.

In West Texas sits a deposit containing an estimated 1.1 million tons.

And it’s not just rare earths.

This site holds gallium, hafnium, zirconium, beryllium, and lithium. All critical for defense… and for the chips that power A.I.

In fact, this single deposit contains 21 of the 22 Intelligence Minerals needed for artificial intelligence.

The small company we’re tracking owns the rights to develop it.

No Pentagon contract yet. But that can be an edge.

This tiny Texas disruptor is moving fast…

They’ve proven phase I rare earth separation and processing test work.

Which means they demonstrated the ability to load and concentrate rare earths as well as critical minerals such as lithium.

It proves the project works in the real world.

And they’re not stopping at mining.

They own a 310,000-square-foot magnet factory they bought overseas. They’re shifting production home to serve defense, EVs, and high tech.

At this rate, I wouldn’t be surprised if they sell out their first round of production before the plant even opens in 2026.

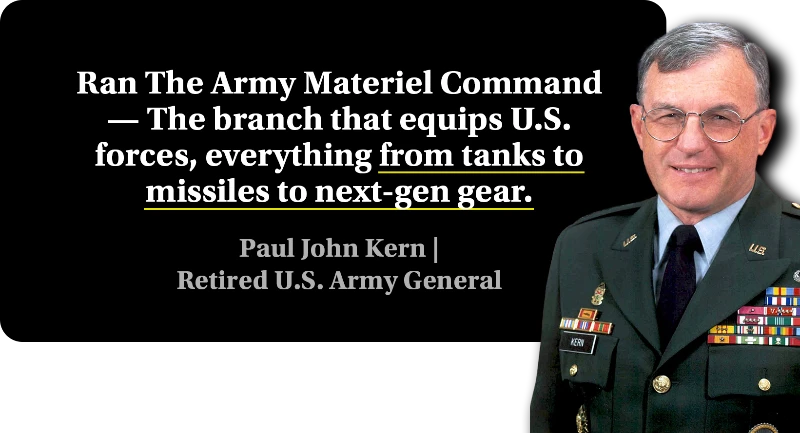

And they have Gen. Paul J. Kern (U.S. Army, Ret.) on the board.

He once ran the Army Materiel Command. That’s the branch that equips U.S. forces — everything from tanks to missiles to next-gen gear.

In short: he knows how the Pentagon buys. He knows who signs the contracts.

If the Pentagon wants a second U.S. supplier, this is the type that gets a fast green light.

That kind of link can move a project from “someday” to “funded” in record time.

And in this business, speed matters.

Because mining can be a lengthy process…

They’re securing buyer agreements now…

It’s the perfect setup for massive gains:

In markets like this, first movers win.

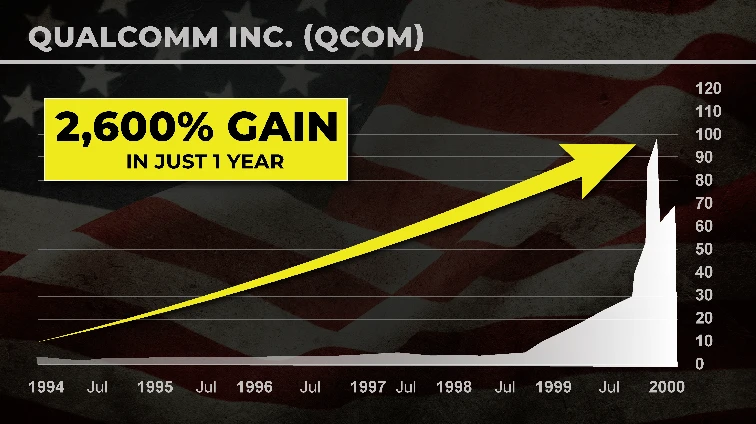

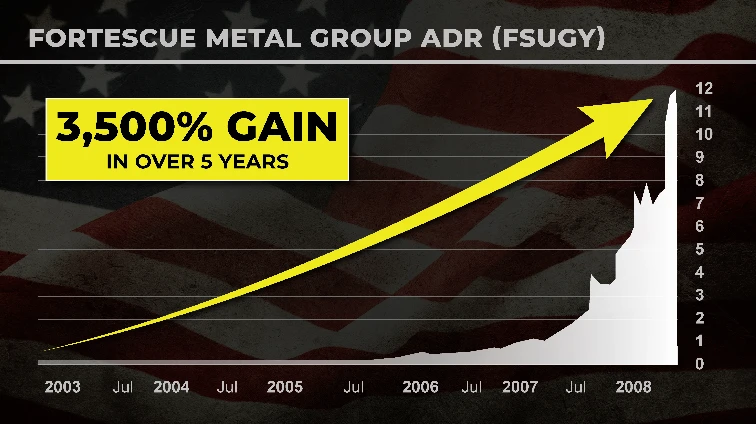

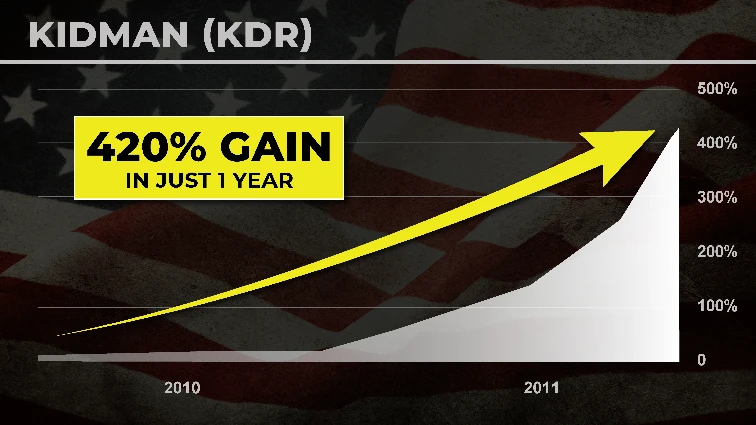

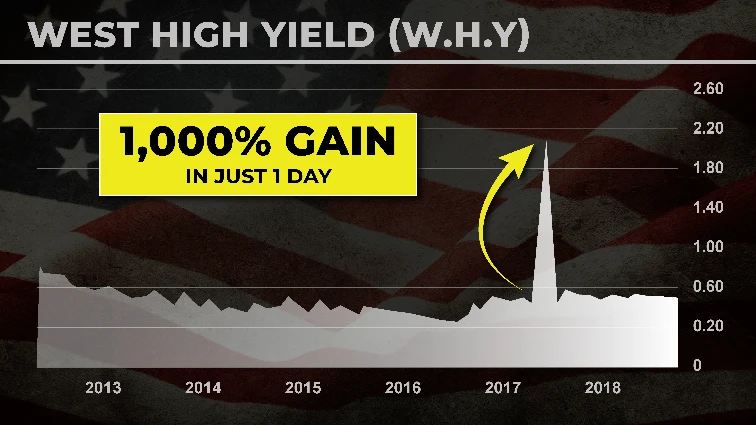

We’ve seen it before:

Right now, defense contractors and major tech firms are scrambling for secure supply.

And this company?

Still invisible to Wall Street.

No headlines. No hype. No crowd chasing the trade.

That gives early investors a rare chance to stake a claim before the first big contract hits.

Which could happen within a few months.

And here’s the key: you don’t need to choose between MP and this tiny disruptor. You want both.

If MP wins more contracts and ramps early — you profit.

If the disruptor strikes first — you profit.

Either way, you’re set up for America’s race to control intelligence minerals.

And in my new briefing—Pentagon-Backed, American Investing Miracles – I’ll give you:

You’ll also see how both fit into Washington’s plan to break China’s 90% chokehold on Intelligence Minerals.

And I’ll send it to you free when you take a 90-day, risk-free trial of Breaking Profits.

Like I said, I spent 25 years on Wall Street managing billions.

As an insider, I saw tools most people don’t know exist. They give the pros a huge edge.

When I ran my hedge fund, I learned one tool in particular.

It’s an indicator I believe is the best predictor of future stock prices.

Here’s what I noticed: when this indicator rises, the stock often follows.

That’s how my team spotted Nvidia in February 2020.

I wrote then:

That’s what happened.

Nvidia’s growth exploded.

Revenues more than tripled…

And Nvidia wasn’t a one-off.

The top 10 S&P 500 stocks of 2024 showed the same pattern before their big runs.

It’s why I also recommended Vistra.

One reader told us:

Cava showed the same setup…

$10,000 there could have become nearly $40,000 in under a year.

Only one place I know tracks it like this: a pro software used by major Wall Street desks.

It’s not cheap. I pay about $52,000 a year for access.

That’s why I say Wall Street plays a rigged game.

The insiders have the tools. Most folks don’t.

But now that I’ve left the institutional world…

I’m breaking that mold.

I’ve partnered with the largest financial newsletter publisher in the world — serving more than 2.2 million readers — to launch Breaking Profits.

This is where I share my best ideas with folks like yourself…

It’s my way to put 25 years of hedge fund experience— in your hands at a price anyone can afford.

Every month, I send you my top ideas.

You’ll know exactly when to buy, when to sell, and why. No guesswork.

Just clear, actionable research you can use right away.

Again, I used to run a hedge fund.

Now you don’t need to be a millionaire. You just need to be willing to act.

And unlike hedge fund clients, you won’t pay crazy fees to access my research.

My old clients were wealthy institutions.

If you didn’t have $1 million in cash, you didn’t make the list.

The good news is, I designed Breaking Profits for everyday people.

We sell memberships for $299 a year on our site…

But my relationship with you is new… and I want to earn your trust.You won’t pay anywhere near that today.

Before we get into price and details…

It’s not about chips, GPUs, or servers.

It’s about ultra-fast data links—the invisible wiring that moves data between AI chips, memory, and data centers. The kind that the Pentagon’s next-gen AI can’t function without.

One small U.S. company dominates this niche. Microsoft and Amazon are scrambling for the high-speed connectivity this business provides.

Without these ultra fast data links, AI crawls.

With them, it flies.

Sales jumped 63% last year — their biggest surge yet.

And management says the next leg of the AI data-center boom could push revenues toward doubling in the coming years.

And because switching suppliers is slow, risky, and expensive…

These deals often turn into multi-year, locked-in contracts.

We’ve seen what happens when companies provide the critical link in a new tech revolution:

This company could be next in line for a breakout of that scale.

And I’ve detailed everything for you in a second special report:

America’s AI Shield: The Tiny Firm at the Frontline of the AI Arms Race.

Inside, you’ll get:

Think of it this way…

MP Materials and the tiny disruptor supply the raw materials to keep AI alive.

America’s AI Shield supplies the circulatory system that lets it thrive.

Together, these three plays put you front-row for the minerals boom and the infrastructure surge—two megatrends converging right now.

Always plan for losses up to your stop. That’s rule #1.

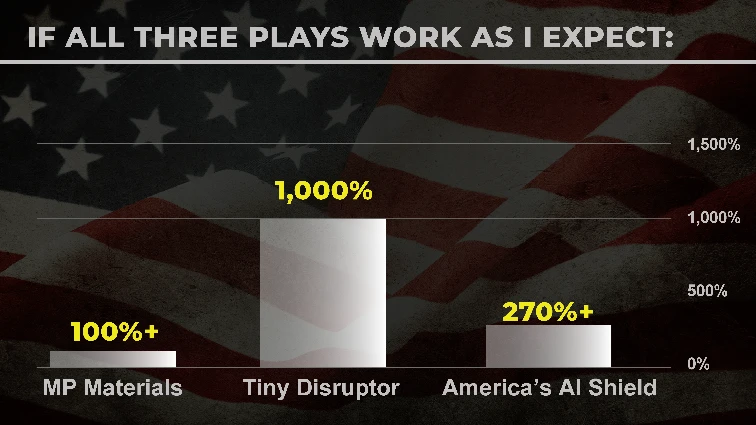

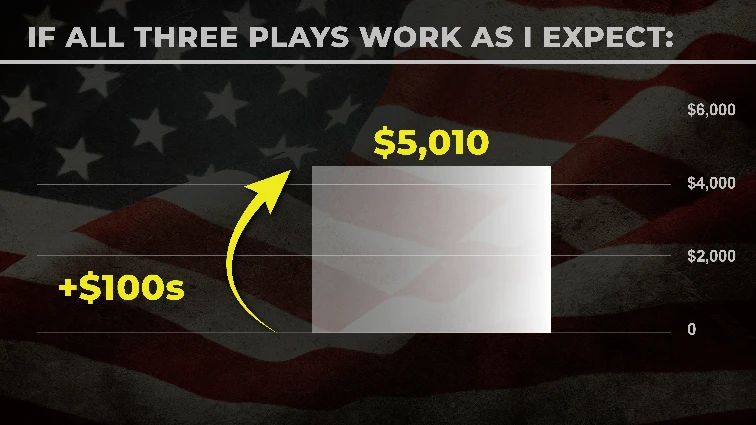

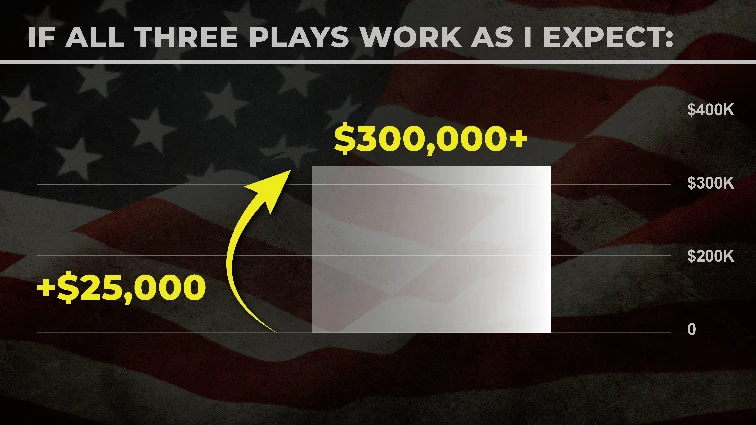

If all three plays work as I expect:

Put a few hundred dollars into each and you could see about $5,010.

Put $25,000 into each—like my old hedge fund clients—and that’s $300,000+.

That’s a wide range. Most people fall somewhere in between.

You can try to track these fast-moving shifts on your own… hoping you catch the right names at the right time…

Or you can use my research, my targets, and my timing—the same process I’ve refined for 25 years—so you’re positioned before the headlines hit.

That’s why I created Breaking Profits.

When you join today, you’ll get instant access to everything you need to position ahead of the crowd.

In a moment, I’ll show you exactly how to claim both special reports… plus a full year of my research… for less than the cost of a single dinner out.

But first, let’s go over what you now know:

Now you face a choice:

Track all this on your own…

Or use my research, my targets, and my timing—the same process I’ve refined for 25 years.

Small caps can move faster and higher than most people think.

Over my career, I’ve seen this play out in the markets over and over…

Every time, the payoff was majorly worth it.

Late 90s… Qualcomm’s stock shot up 2,600% in a single year when its mobile chip tech became the industry standard.

Later Fortescue Metals… up 3,500% during China’s steel boom over the 5 years following the Chinese market collapse in 2015 .

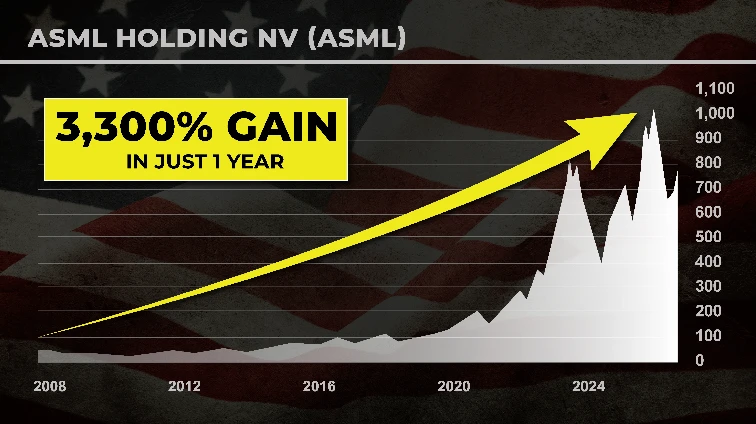

ASML…up nearly 3300% as it locked down a monopoly on advanced chipmaking tools during the decade-long bull run following the housing crisis in 2008.

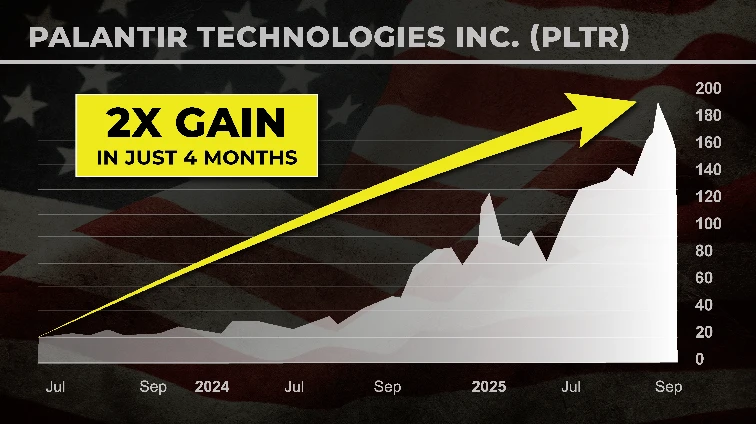

And Palantir… a quick double in just four months after big AI and defense contracts hit the news.

When urgent demand collides with a scarce solution and the market wakes up…

I’ve already done the heavy lifting:

The research.

The vetting.

The back-channel calls.

I know exactly which companies to target, what prices to pay, and how to protect the downside while aiming for retirement-defining upside.

And now I’m putting it all in your hands.

But you do not have the luxury of waiting.

Beijing’s deadline could choke supply without warning.

By the time CNBC blasts a headline, the move may be over.

This is your chance to move with the insiders — not behind them.

When you join Breaking Profits today, you’ll get instant access to:

Plus, you’ll receive:

All of this, not for the $299 retail price for a year… not for $199… not even for $99.

Today, it’s just $49 for six months— over 80% off — and fully risk-free for 90 days.

Take three months. Read the issues. Get the tickers. Act on the setups.

If it’s not for you, get a full refund — and keep everything.

The only real risk is missing it.

There’s a button on your screen right now. Just click “JOIN NOW” to become the newest member of Breaking Profits today.

JOIN NOWI’ve seen what happens when readers act. I’ve heard from countless followers across my services over the years.

My favorite?

Mark even recorded a video telling his story.

Now, I want you to be my next success story…

To reward fast action…

If you join today, I’ll also send you my Fast-Action Bonus Report — The AI Kill Switch Map.

Many of these names are in 401(k)s, IRAs, and brokerage accounts right now.

In this bonus, I’ll name each one, show you why it’s at risk, and give you my hedge-fund-grade alternatives that could soar if those names collapse.

Because while some companies will be caught flat-footed, others — especially the ones securing Pentagon contracts and domestic supply lines — could emerge as the saviors of America’s AI future.

That’s where the biggest fortunes will be made.

And with the Pentagon’s clock already ticking…

Every day you wait is one less day to prepare before Beijing makes its move.

Now it’s time to act.

Click below to lock in your $49 risk-free membership — plus your Fast-Action Bonus — before this window closes.

JOIN NOWRemember: Breaking Profits retails for $299.

And remember — your $49 offer today isn’t per month… it’s for the next six.

When you join today, you’ll get:

You have 90 days to try it out — risk-free.

Don’t like my research, my picks, or even my style? Tell my team and get a full refund. No hassle. No fine print. Keep everything you’ve received.

Think about it…

You’ve seen my track record.

You’ve seen the Pentagon’s moves.

You’ve seen why the next six months could redefine America’s AI future.

Beijing’s threat is real.

When they act, it will be instant.

By the time the headlines hit, the stocks may have already moved.

Right now you can get all of my research with every ticker, buy-up-to price, and exit plan — for $49, risk-free for 90 days.

Three urgent trades.

Massive upside potential.

A 90-day guarantee.

Miss this window, and there’s no rewinding the clock.

With that, I’m Enrique Abeyta.

And I hope to welcome YOU to Breaking Profits today.

Click the “JOIN NOW” below now — and let’s win this AI race together.

September 2025

JOIN NOW

![“[The indicator] has started moving higher. We could see the company double or triple revenues.”](https://d2z65klgtz99km.cloudfront.net/BAD/bad_switch_0925/BAD_Kill-Switch_FS_16.webp)

![“I’m up 53% in Vistra [in about six months], a $37,000 profit.”](https://d2z65klgtz99km.cloudfront.net/BAD/bad_switch_0925/BAD_Kill-Switch_FS_17.webp)