Hi, Matt Insley here…

I’m the Publisher of Paradigm Press…

And I'm recording this video because this contract I just signed will completely change our business…

It could also change your life in the next 60 days.

Let me explain…

If you’re a long-time reader of Paradigm Press…

You know that we have an inner circle of world class thinkers.

I’m talking about former advisor to the CIA and the Pentagon, Jim Rickards…

And crypto millionaire, renowned entrepreneur, and best-selling author James Altucher.

Over the years, we’ve been thrilled to bring you some of the biggest and boldest predictions…

As well as market-beating results.

Their work has changed the lives of hundreds of thousands of readers.

You may be one of them.

And while I’m proud of the work we’ve done…

I’m not here to talk about the past…

I’m here to talk about the future.

And that’s where the contract comes in to play.

After months of negotiations…

We just recruited a third world-class thinker into our inner circle.

This man is a legendary trader who used to manage billions on Wall Street…

And thanks to the contract…

He’s now contractually bound to share his best ideas with our readers like you.

In fact, he just went public with his first official recommendation…

I’m talking about three stocks he believes could skyrocket in the coming days.

And I highly recommend you get the details now…

Because this Wall Street legend believes that between now and President Trump’s inauguration…

You’ll have a rare window to help accelerate your retirement in ways you never thought possible…

Without investing in options, futures, or anything extra risky.

This new recommendation is based on an obscure pattern that he believes is the #1 driver of the biggest stock market gains in history.

It’s the same pattern that appeared before the rise of ALL of the top 10 performing stocks in the S&P 500 index in 2024, including…

Palantir:

Vistra:

And Nvidia:

This Wall Street legend recently gave an interview where he revealed all the details.

I highly recommend you watch this interview right now…

Because this same pattern just appeared for THREE stocks.

And that means they could skyrocket in the coming days.

Which is why this man is recommending you buy them immediately.

And whenever this former hedge fund manager talks…

You should stop and listen…

Because he’s the real deal.

His track record is just mind-blowing.

97% of money managers cannot beat the market over the long-run.

But from 2001 to 2011…

A period that included the dot.com bust and the 2008 housing meltdown…

This man beat the S&P 500 index 3 to 1.

He has also predicted some of the most powerful market booms of this decade.

For example, in February 2020, when nobody was talking about Artificial Intelligence…

He and his team picked Nvidia…

And predicted the company’s sales would triple because of its dominant position in AI chips…

Which is exactly what happened in the following years.

Anyone who listened to him and bought and held shares had a chance to turn $10,000 into $230,000 today.

In the middle of the Covid pandemic in 2020, while stocks were crashing and everyone was panicking…

This man and his team picked a series of stocks that he believed would benefit from a pandemic recovery

That turned out to be almost the precise market bottom.

Less than a year later, ALL of the stocks he picked were up double and triple-digit gains.

So please turn off any distraction…

And grab a piece of paper and pen to take some notes…

Because he’s now recommending THREE stocks for the coming 60 days.

So please watch this interview now before it’s too late.

Doug Hill:

Hi, I’m Doug Hill, and I’ll be your host for this special event.

This is truly a historic day for our firm…

Because we’ve managed to recruit a true Wall Street legend who we believe could help change the lives of many of our readers.

We call him The Maverick…

And he’s the only person I know in our industry who has managed billions of dollars.

During his time as a professional trader on Wall Street…

He founded or was a founding member of three hedge funds…

Including a fund that went on to become one of the top 100 hedge funds in the world in 2019 in terms of assets under management.

And in total, he managed nearly $4 billion in assets at their peak.

We’re happy to have him here with us today because it seems like everything he touches turns into gold.

His name is Enrique Abeyta…

And I can’t wait for you to hear more about this opportunity to accelerate your retirement in the next 60 days.

Enrique, we’re glad to have you here.

Enrique Abeyta:

Doug, thanks for having me.

I want to thank everyone who joined us today because we don’t have much time to prepare.

We’re already seeing a melt up in certain sectors of the market…

Many stocks are already going absolutely crazy, and…

I believe in the next 60 days…

Everyone here will have a chance to accelerate their retirement in a way they never thought possible…

Without trading options, futures or anything extra risky.

Doug Hill:

Are you talking about this so-called “60-day accelerator window”?

Enrique Abeyta:

Correct.

You see, historically the stock market has gone up 10% a year on average…

So if you’re planning for retirement and you’re just making that kind of annual return…

You could spend decades saving and investing and not really move the needle.

It can feel like you’re on a hamster wheel, running and running but never getting anywhere.

That’s what most people do.

And it’s why most struggle in retirement.

But in the next 60 days, I’ll be tracking over 1,000 stocks that could see big moves. And I believe if you know what to do, you could make the equivalent of many years of stock market gains…

Sometimes in a matter of just a few days.

Unfortunately, most people will miss out on this coming 60-day boom

Doug Hill:

What makes you say that?

Enrique Abeyta:

I believe most people will miss out because the only way I know of catching these fast-money trades is by using this obscure pattern…

Take a look at this.

Most people don’t know about it, but it can be as easy as 1-2-3.

Doug Hill:

1-2-3… yeah, sounds simple enough…

Maybe even too simple.

There has to be more to it, right? Can you explain what it is for us?

Enrique Abeyta:

Oh, on the surface, it looks simple… but as you’re about to see, this is the single most powerful tool I’ve discovered in my entire career on Wall Street. I learned about it when I was running those hedge funds you just mentioned.

All the big players on Wall Street know about this pattern.

But the sad reality is… this is an invisible pattern for most people.

Doug Hill:

Invisible?

What do you mean?

Enrique Abeyta:

Let me show you…

There should be a chart coming up on the screen.

This is the price chart of a company called Vistra Energy Corp.

And if I asked you to look up this company, that’s what most people would see.

Doug, just by looking at it…

Can you tell me if this stock is more likely to go up or down from here?

Doug Hill:

Just by looking at the chart? I have no idea.

Enrique Abeyta:

Right, it’s impossible to say if the stock is more likely to go up or down.

But let me add another line to the chart.

See this blue line?

It’s invisible to most people….

But is tracking the #1 predictor of stock prices.

The research firm Zacks even called it…

And as you can see, we get this pattern after we see this line going up three times in a row.

1…. 2… 3…

Can you see that?

Doug Hill:

Yep. I see it.

Enrique Abeyta:

Whenever you see that pattern, it means this indicator will likely keep going higher.

And that’s a big deal because if there was one thing I learned in my 25 years on Wall Street, it is this…

This blue line you see on the chart is the single best predictor of stock prices…

So if you see this line going up and to the right…

The stock price will normally follow.

Look at what happened with shares of Vistra Energy.

You get the 1-2-3 pattern…

Then boom, this indicator skyrocketed higher….

Now Doug, remember, this blue line is the #1 driver of stock prices.

So what do you think happened to this stock?

Doug Hill:

It went up?

Enrique Abeyta:

Take a look…

The stock also exploded higher…

And anyone who bought shares on the day the pattern appeared….

Had a chance to turn $10,000 into more than $67,000 in less than three years.

Doug, that’s a 573% gain…

Normally, it would take 57 years for the stock market to produce that kind of return.

So, you’re compressing decades of stock market gains in a period of less than three years.

And that, my friend, is how you can help accelerate your retirement…

Without buying options, futures or anything extra risky.

Doug Hill:

Ok, so instead of waiting almost six decades, you could have made the same gains in just a few years?

Enrique Abeyta:

Right. Now, this is a top example we found looking back at the markets. It is good to remember that past results do not guarantee future success.

Doug Hill:

Yeah, that’s common sense. I think everyone knows that all investing carries risk, but I find this pattern very interesting.

So let me see if I get this right.

You’re saying this blue line is the biggest predictor of stock prices.

Most people can’t see that line…

But if it goes up, the stock is very likely to follow.

And this 1-2-3 pattern tells you exactly when it’s starting to go up…

So, all you have to do is wait for that indicator to rise three times in a row?

Enrique Abeyta:

That’s it.

1…2….3…

Once you see that pattern, there’s a good chance the stock will explode higher.

This pattern has been behind some of the biggest stock gains I’ve seen in my 25-year career…

And it appeared before the rise of every single one of the top 10 S&P 500 stocks of 2024

Doug Hill:

Every single one?

There’s not even ONE exception?

Enrique Abeyta:

Every single one.

This stock I just mentioned, Vistra, was one of them…

And I’ll show you some more top examples in just a few minutes.

Doug Hill:

Yeah, I know that you already shared this secret with some of your readers because I’ve seen some feedback about that stock you just mentioned, Vistra.

Like this one from Ed.

He wrote:

![Testimonial from Ed B.: “I’m up 53% in Vistra [in about six months], a $37,000 profit.”](https://d2z65klgtz99km.cloudfront.net/MVK/mvk_launch_1124/MVK_GFX_FS_04_800x450.webp)

I mean, $37,000 in six months is no joke.

Enrique Abeyta:

I’m telling you, Doug…

Once you learn how to spot this pattern…

Making money in the market could become as easy as 1-2-3

And I want to share this with everyone here today because this pattern will play a key role in this coming 60-day retirement accelerator window.

Doug Hill:

That sounds great. But let me ask you this…

You said this is the #1 predictor of stock prices.

I was trying to guess what that is…

And I actually think I know what you’re talking about.

You’re talking about earnings results, aren’t you?

Enrique Abeyta:

No.

That’s the funny thing about this 1-2-3 pattern.

It’s not earnings.

And it has nothing to do with economic growth, valuation, interest rates, market sentiment or anything you’ve likely heard before.

Look, people like to complicate investing with a bunch of technical indicators, financial statements, economic projections…

But a lot of times, all that stuff is just noise.

Doug, after managing nearly $4 billion as a hedge fund manager…

And after dealing with all the major trading desks on Wall Street, like Goldman and JP Morgan…

I can tell you this 1-2-3 pattern is the single most important thing all of the big dogs on Wall Street pay attention to.

If you learn how to spot this pattern,

you can unlock the keys to the kingdom

In fact, before I buy any stock…

The first thing I check is if this predictor is going up.

Because if it’s going up, the stock will normally follow it. For example…

This pattern appeared in shares of Howmet Aerospace…

1…2….3.. then the stock predictor skyrocketed…

And the stock followed it higher for gains of 135%…

So, anyone who bought shares when the pattern appeared had a chance to more than double their money in a little over a year.

The same pattern appeared for shares of NRG Energy in December 2022…

1…2…3… Then…. boom, the stock predictor moved up and to the right….

And so did the stock… jumping as high as 213%…

So anyone who bought shares when the pattern appeared had a chance to turn $10k into more than $31,000 in less than two years.

This same pattern appeared for shares of Constellation Energy Corp. in May 2022…

1…2…3…

Boom, the stock predictor skyrocketed higher.

And by now, Doug, you know what that means, right?

Doug Hill:

The stock followed right after it.

Enrique Abeyta:

Yep… It rallied as much as 416% in less than three years.

Enough to turn $10k into more than $51,000 during that period.

Doug, these top historical examples were opportunities to make the equivalent of 13, 21, and even 41 years of average stock market gains…

All in a matter of just a few years.

That’s why I believe this obscure pattern could be a game-changer for everyday folks…

Especially in this coming 60-day retirement accelerator window.

I believe in the next 60 days this pattern will be popping up all over the place…

Telling us exactly where to invest.

Doug Hill:

Yeah, just by looking at those charts…

It does seem like stocks follow this indicator.

This is all mind-blowing, so I can’t wait to get into the details.

But what exactly is happening in the next 60 days?

Enrique Abeyta:

I promise I’ll explain everything today because I believe we’re about to see a massive shift in the stock market.

I predict the entire stock market landscape will change in the next 60 days…

Popular stocks that have been doing really well could begin to crash…

Others that have been underperforming could begin historic rallies…

And this 1-2-3 pattern will help us pick which stocks to avoid, and which ones to buy.

Enrique Abeyta:

I promise I’ll explain everything today because I believe we’re about to see a massive shift in the stock market. A mere THREE weeks ago today, Donald Trump won his second term in the White House and there’s BIG money on the move. This is a critical moment for Americans who want to make the most of their money and retirement.

Because I predict the entire stock market landscape will change in the next 60 days.

Popular stocks that have been doing really well could begin to crash,

Others that have been underperforming could begin historic rallies,

And this 1-2-3 pattern will help us pick which stocks to avoid, and which ones to buy.

And look, for you watching at home…

I estimate over 1,000 stocks could be impacted by this coming market shift.

Even if you end up not using my 1-2-3- strategy…

I think it’s important that you understand what’s happening in the next 60 days because if you don’t….

You could end up holding the wrong stocks…

And you could end up losing a ton of money.

So here’s my plan for the rest of this broadcast…

I’ll explain what’s happening in the next 60 days… and why I believe we’ll see this 1-2-3 pattern popping up all over the stock market…

Creating hundreds of opportunities to accelerate your retirement.

I’ll reveal exactly what this #1 stock predictor is…

And I’ll explain how it could help you pick the top performing stocks of 2025.

I’ll also discuss my top three trades for the next 60 days…

And I’ll even give away a couple of free picks…

I’ll tell you the name of one stock to buy…

And one stock to avoid, completely free of charge.

And when I say free, I mean it.

I’m not going to ask you to subscribe to any of my services or make you jump through any hoops.

Doug, how does that sound?

Doug Hill:

It sounds amazing.

Folks, we’re just getting started here.

We’ll also have a Q&A later in our broadcast.

As Enrique just mentioned…

He’ll also give away the name of one stock to buy and another one to avoid.

Stick around for just a few minutes, and you’ll get this free pick.

And trust me…

You don’t want to miss this free pick because Enrique has made millions for his Wall Street clients…

And helped them accelerate their retirement by picking some of the fastest moving stocks in the market…

For example, he made…

230% in 23 months in shares of TRW Automotive Holdings

124% in 24 months in shares of Solutia Inc

And 788% in 10 months in shares of General Growth Properties…

Just to mention a few.

But what really made him a legend on Wall Street was the series of prescient calls he made during some of the most turbulent markets over the past 25 years.

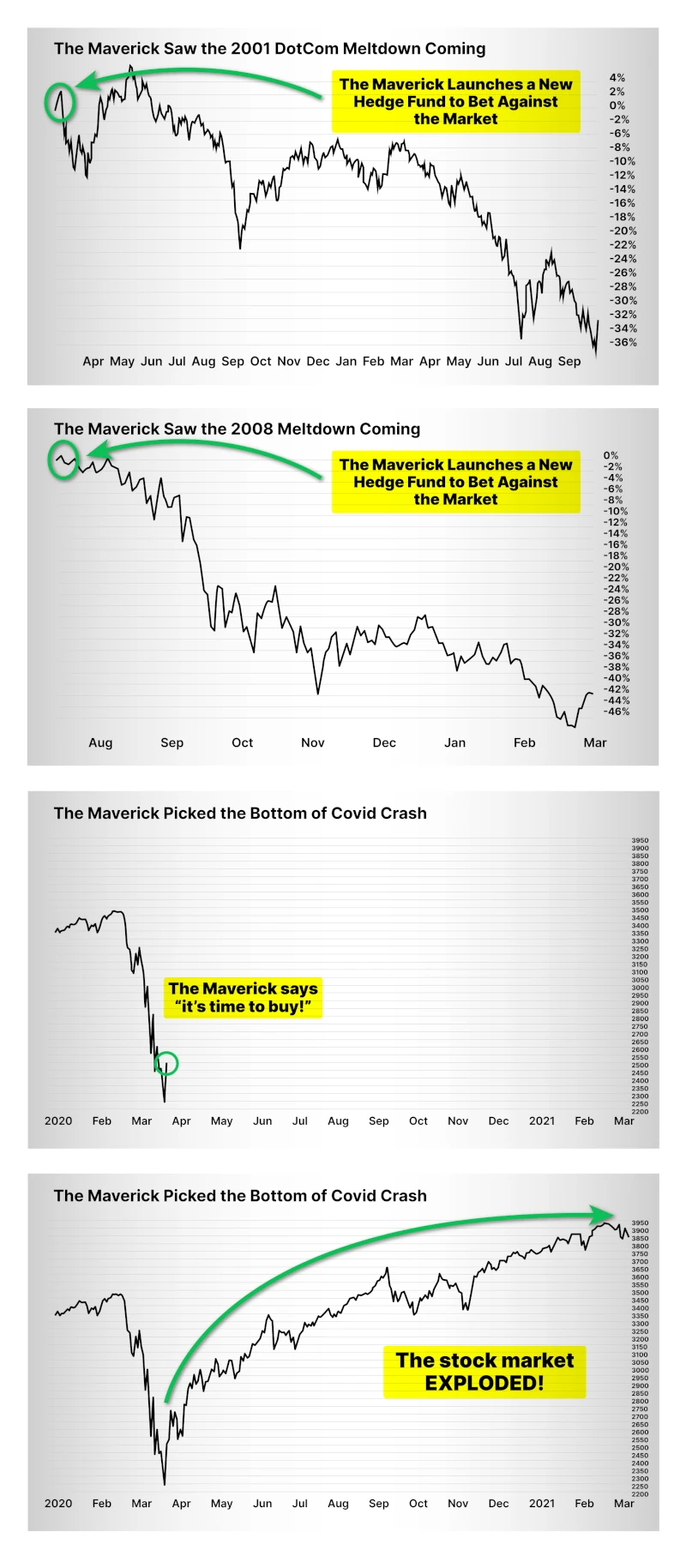

For example, in March of 2001, the U.S. economy entered a recession and tech stocks were in free fall.

That was the dot-com bust.

That same month…

He launched a new hedge fund to take advantage of that crisis.

From March 2001 to September 0f 2002, most people lost money because the S&P 500 crashed 32%…

But not Enrique’s clients.

Somehow his fund actually went UP 12% during that bloodbath.

Then when the next big crash came, he did it again.

In August 2008, in the midst of the housing meltdown…

He launched another hedge fund designed to profit from the carnage he saw coming on Wall Street.

One month later, Lehman Brothers collapsed…

Panic took over…

And the stock market crashed.

During those chaotic few months from August 2008 to March 2009, the S&P 500 index dropped 47%…

But while most investors were losing a big chunk of their retirement…

Enrique’s clients actually MADE millions during that period.

Folks, most funds cannot even beat the market.

According to research from the S&P and Dow Jones Indices…

Up to 97% of actively managed stock funds failed to beat the market in a 10-year period.

But from 2001 to 2011… a period that included two massive market crashes…

Enrique not only beat the S&P 500 index…

He crushed it with returns that were more than 3 times higher than the market.

That puts Enrique among the top 3% of money managers on the planet

He’s a true stock market maverick who’s not afraid to go against the grain. For example, look at what happened in the last stock market crash in 2020.

In the middle of the COVID pandemic, while stocks were crashing and everyone was panicking…

He told his readers the COVID crash was creating the best investing opportunity of the past decade.

He said, and I quote:

Take a look at his timing… it’s mind-blowing…

This was just one day after the market bottom.

And he and his team picked a series of stocks that he believed were about to explode higher.

After he made that call, the stock market took off in “V-shaped” recovery and never looked back.

Less than a year later, ALL of the stocks he picked were up by double- and triple-digit gains…

For example, his readers had a chance to book 36% on TripAdvisor, and shares went on to jump as high as 228%…

He booked a 124% gain in Capri Holdings… and shares went on to jump even higher, 409%.

He booked a 428% gain on casino company Penn National Gaming… and shares then skyrocketed for an incredible 933%…

These were all market-beating returns…

Each of those picks gave Enrique’s readers the chance to make the equivalent of decades of stock market returns in less than a year.

Enrique, that’s pretty impressive…

So the question is…

How?

How did you do it?

You must have a crystal ball somewhere.

Enrique Abeyta:

Of course there’s no such thing in the investment world.

I was able to make those calls because I don’t blindly follow the herd… and I used a few different indicators that help me time the market…

Including this little-known pattern I’ve been telling you about.

I believe it is as close to a crystal ball as you can get.

It’s the main secret behind all of my success.

Doug Hill:

All right, so let’s get into the details here because I find this all fascinating.

And I want to start with something you said earlier that caught my attention…

You said this pattern actually appeared before the rise of every single one of the top 10 performers of the S&P 500 index in 2024.

Is that real?

I don’t want to rain on your parade, but it just sounds too good to be true…

I mean, if you can pick every single one of the best performers…

You’ll be in a position to make a lot of money.

Enrique Abeyta:

Yes, I realize it sounds too good to be true.

But like I mentioned before, this pattern literally tracks the #1 predictor of stock prices.

So if you know how to spot it…

Picking the right stocks could be as easy as 1-2-3

Let me show you a few examples involving some of these top performers in 2024.

Let’s look at Palantir Technologies, a company that provides software for the US intelligence community.

Take a look at this chart…

It doesn’t look good, does it?

Doug Hill:

It looks horrible.

That’s brutal.

Enrique Abeyta:

It looks like death.

In 2021 and 2022, the stock crashed more than 80%.

After that big crash, in October 2022…

A Morgan Stanley analyst cut the firm’s price target and predicted that it would continue to struggle in 2023.

Then, a month later, Jim Cramer was screaming “sell, sell, sell” on his CNBC show.

In early 2023, another analyst downgraded the company because of its weak growth prospects.

Doug, given all this information and looking at that ugly chart, would you buy this stock?

Doug Hill:

No way. Are you crazy?

I wouldn’t touch it with a 10-foot pole.

Enrique Abeyta:

On the surface, you’d have to be crazy to buy this stock.

But let me show you another chart…

As you can see here in this blue line, the stock predictor was in free fall during that crash…

So it was basically telling you to stay away.

But in early 2023, the 1-2-3 pattern appeared.

Can you see it?

Doug Hill:

Yep, I see it. So this was a sign that this predictor was about to go higher?

Enrique Abeyta:

It was a sign that things were about to change for sure.

Take a look…

Shortly after the pattern appeared, the stock predictor began to move higher.

And when this line is going up and to the right…

No matter how bad the outlook for the company is…

I’ve found it’s likely for the stock to follow.

So even though analysts were downgrading the company and telling everyone to stay away from it…

The stock actually started to follow the predictor…

Anyone who ignored all the doom and gloom and bought shares when the pattern appeared…

Had a chance to turn $10k into as much as $40,000 in less than two years.

Isn’t that incredible?

Doug Hill:

It really is… especially for a stock that looked like a complete dud.

Enrique Abeyta:

Normally, it would take you three decades to make that kind of money in the stock market.

So, this was a rare top opportunity to compress three decades of wealth building into a couple of years.

Doug, can you see how this could help folks accelerate their retirement?

Doug Hill:

Absolutely.

It does seem like this pattern could be a game-changer.

But if this is such an important driver of stock prices…

How come most people don’t know about it?

Enrique Abeyta:

Like I mentioned before, this pattern is invisible to most everyday folks…

But all my friends on Wall Street know about it.

They not only know about it… but there are more than 30,000 financial analysts whose sole job is to track this number…

And they’re spread out across more than 3,000 different financial institutions.

Every single Wall Street firm, from Goldman Sachs to Morgan Stanley to JP Morgan…

They all track this number…

Because they know this is as close to a holy grail as you can get

Let me show you another example involving another top performer of 2024.

Let’s take a look at a company called Targa Resources Corp.

Have you heard of it?

Doug Hill:

No, never.

Enrique Abeyta:

Most people haven’t.

But it’s a Fortune 500 company that delivers natural gas in the U.S.

And it’s one of the best performing stocks of 2024.

Take a look…

You can see the stock was just moving sideways when this pattern appeared at the end of 2021.

That was a sign the stock predictor was about to skyrocket.

And that’s exactly what happened.

It went up and to the right. So guess what happened with the stock?

Doug Hill:

It went up and to the right.

Enrique Abeyta:

Take a look….

Doug Hill:

Wow… I can see that even though the predictor kept moving higher in 2022 and 2023…

The stock spent a few months just going sideways.

Enrique Abeyta:

Right, but remember…. In my experience, I found it’s unlikely for the stock not to go up if this predictor is going up.

Of course, nothing is guaranteed in the market, but this really puts the odds in your favor…

So eventually the stock caught up to it…

And anyone who bought shares when the 1-2-3 pattern appeared and timed this trade perfectly had a chance to turn $10k into more than $31,000 in less than three years.

Again, that’s the equivalent of 20 years of average stock market gains compressed into just a few years.

Or let’s look at Super Micro Computer, a company that provides infrastructure to AI data centers.

Doug Hill:

Oh… if it’s an AI stock, I bet it’s booming.

Enrique Abeyta:

Well, shares actually spent most of 2021 and 2022 going nowhere, as you can see here.

But the pattern appeared in early 2023.

This was a sign that this would be the beginning of a new trend…

And that’s exactly what happened… the stock predictor kept moving higher and higher…

And it meant the stock had no way to go but up.

Anyone who invested $10k when the pattern appeared in early 2023…

Had a chance to turn that into almost $70,000 in less than two years.

Again, if you compare these results to the average stock market gain…

We’re talking about making the equivalent of almost six decades of gains… all in less than two years.

Doug, I’m 52 years old…

I can’t wait six decades to see big gains.

Doug Hill:

Yeah, we’re not getting any younger.

I’m sure a lot of the folks watching this can’t wait that long either.

Enrique, this could really help folks who have fallen behind in their retirement plans.

It could help them catch up.

But you just said most folks can’t even see this pattern.

You said that all of your Wall Street friends know about this pattern, but most people don’t.

So are these Wall Street bankers just keeping this secret to themselves?

Enrique Abeyta:

Unfortunately, most everyday folks don’t know about it because this number is NOT published in any SEC filings.

And you definitely won’t find this pattern walked out just by Googling it.

Doug Hill:

So it’s not easy to access it?

Enrique Abeyta:

It’s not.

In fact, I only have easy access because I personally pay about $52,000 a year to have access to this data.

I get access to a special software program that keeps track of that stock predictor for thousands of stocks.

You can see here a screenshot of this software tracking this predictor for shares of Apple.

Now, $50 grand a year is not a lot of money for these big banks on Wall Street.

So they’re happy to pay that fee.

But that’s a lot of money for everyday folks.

Doug Hill:

Yeah, that’s an annual salary for some people.

Enrique Abeyta:

Right, but here’s the good news…

Today I’m going to reveal everything.

I’m going to show everyone here today how they can also take advantage of this pattern because I don’t think it’s fair.

I don’t think it’s fair that only rich Wall Street bankers are using this to pick stocks.

I mean, I’m doing well today…

But I come from very humble beginnings…

When I was growing up, at one point my family was so broke that I was homeless and had to sleep in an old Ford LTD station wagon for a couple of days. Now I’ve got to admit, I was an 8-year-old kid at that point so I thought we were just camping. But that’s the kind of life experience that gives you perspective.

And after having so much success on Wall Street…

The least I can do is share this secret with everyone here today to try to level the playing field.

And that’s especially important now because…

Like I said before, this pattern will be the key to this coming 60-day retirement accelerator window.

Doug Hill:

Yeah, you probably have the most incredible rags to riches story I’ve ever heard.

And I’m sure we’ll get into more of that later in our broadcast.

I also want to remind everyone that we’ll have a Q&A later…

And that Enrique will give away a couple of investment ideas, completely free of charge.

Folks, as I mentioned before…

Enrique is a maverick who operates outside the mainstream … outside of typical investment strategies…

And because of that, he has been able to deliver some amazing results for his readers.

So you don’t want to miss these investment ideas.

He’ll give away the name of one stock to buy and one to avoid in 2025…

He’ll discuss how this 1-2-3 pattern could help you pick the top performing stocks of 2025…

And he’ll explain how you’ll have a chance to accelerate your retirement in the next 60 days.

But before we get to all that…

I want to get into the details of this strange 1-2-3 pattern.

Enrique, you said that it tracks a specific number that’s the #1 driver of stock prices.

So what is that number?

Enrique Abeyta:

Before I reveal what that is…

I need to give you some context to explain exactly how Wall Street works.

You see, before Wall Street analysts give a stock a buy or sell rating…

They run a bunch of financial models to determine the fair value of the stock.

The fair value is basically what they believe the company is worth.

So for example, if they believe the fair value of a stock is $100 per share…

But shares are trading at $80, they’ll issue a buy rating.

Does that make sense?

Doug Hill:

Sure. If the price is below the fair value, it means the stock is cheap.

They expect the price to rise to the fair value, right? So in that example, they’d expect the price to go from 80 t0 100.

Enrique Abeyta:

Correct.

Now, in order to determine the fair value of any stocks, these analysts have to run financial models…

They have to make assumptions about sales, growth, operating margins, etc…

They have to analyze the economy, industry trends, competitors, etc…

But the most important input in those valuation models is the estimate of future earnings.

If for whatever reason analysts on Wall Street begin to believe that the company will earn more than they estimated before…

They’ll have to adjust their estimates for future earnings.

When those estimates go up…

The fair value of the stock also goes up.

Doug Hill:

So the company becomes more valuable?

Enrique Abeyta:

Right.

And when the company becomes more valuable…

The price of the stocks normally follow.

As Forbes says…

And that’s why this stock predictor works so well…

It tracks the average earnings estimates of all Wall Street analysts.

Doug Hill:

So, when you see that blue line that you showed earlier going up…

It means analysts are revising their estimates…

They’re increasing their estimates of future earnings for the company?

Enrique Abeyta:

Correct.

And history shows that when that happens three times in a row, it’s the beginning of a new trend of revisions….

Where the analysts will just keep increasing their estimates…. Which increases the fair value of the company.

Let me show you what happened with Nvidia, for example…

And I think everyone will understand better why this indicator can be so reliable.

There should be a chart coming up.

As you can see here, analysts were revising earnings estimates DOWN in 2019…

Primarily because of weak demand for its video-game chips…

Which is more cyclical than other areas of their business, like AI chips.

Doug, can you see those cuts in earnings estimates?

Doug Hill:

Yep, I can also see that the stock had a huge correction.

Enrique Abeyta:

Right, this stock predictor works both ways, up and down.

If earnings estimates are getting cut, the stock will most likely drop.

Which is what happened with Nvidia in late 2018.

But things began to change at the end of 2019…

When analysts began to revise their estimates higher.

For example, one analyst from Morgan Stanley wrote at the time:

And this was just one analyst.

The truth is several analysts on Wall Street began revising their estimates higher at the end of 2019…

And that’s why the pattern appeared in December…

When we got three consecutive rises in earnings estimates.

Doug Hill:

So this was a sign the prospects for the company were improving?

Enrique Abeyta:

It was a sign it would be the beginning of a new trend of revisions.

So shortly after that, in February 2020…

My team and I recommended shares of Nvidia to my readers.

Here’s what I wrote…

And by the way, GPUs are the chips that are being used in AI.

And I said…

So here’s what happened after our recommendation…

Just like the 1-2-3 pattern predicted, analysts kept revising earnings higher, higher and higher….

Doug Hill:

And why do you think that happens?

Why do you think that after 3 consecutive rises in earnings revisions, we get a long-term trend of revisions?

Enrique Abeyta:

Because normally when that pattern appears, it’s a sign the company is entering a period of hyper growth…

Where growth is much faster than what any analyst was predicting…

So they need to be constantly adjusting their numbers.

Doug Hill:

So Wall Street analysts are playing catch up the entire time?

Enrique Abeyta:

That’s a good way of putting it.

And that’s what happened to Nvidia.

The AI boom caught most people by surprise…

And the company began to grow much faster than anyone expected.

That’s why analysts had to make so many revisions.

For example, more than three years after I picked Nvidia, analysts were still playing catch up.

On May 24, 2023…

The company had a historic blowout earnings announcement…

And it projected sales almost $4 billion higher than what analysts were expecting.

So this wasn’t a rounding error…

Analysts were off by almost $4 billion in sales.

That’s when everyone realized the AI boom wasn’t just a fad.

And analysts began to furiously raise their estimate even more…

Raising their price target for the stock.

Nvidia was all over the headlines…

From the Wall Street Journal…

To Bloomberg…

To Forbes…

It was truly a historic day.

The company more than tripled its revenue, just like I predicted.

But remember, this was more than three years AFTER I picked the stock…

More than three years AFTER I spotted the 1-2-3 pattern and recommended the stock.

So had you waited for those headlines, it would have been too late.

However, anyone who followed our recommendation…

And bought and held shares of Nvidia when we recommended in February of 2020…

Had a chance to turn $10,000 into $230,000 today.

Doug Hill:

My goodness.

For some folks, that would be an entire nest egg… from just one stock.

I’m starting to see why you said earlier that this 1-2-3 pattern is as close to a crystal ball as you can get.

Enrique Abeyta:

It really is.

I would never have picked Nvidia without this pattern.

You know, Doug, most people don’t realize this…

But these earnings estimates are a big deal because it’s the main input of Wall Street’s valuation models.

So when they increase their estimates, they also normally raise the price target of that stock…

Just like what happened after that blowout earnings.

And these target prices are a big deal for institutional investors.

If you have a stock trading for $100…

And pretty much all the Wall Street firms are saying the stock is worth $125….

Doug, what do you think institutional investors will do?

Doug Hill:

They will backup up the truck…

They’ll go all in on that stock.

Enrique Abeyta:

Exactly.

Institutional money is going to be all over that stock.

I’m talking about potentially billions of dollars going into the stock…

Helping push the stock much higher.

I believe that’s what happened with Nvidia.

Normally, by the time everyday folks learn about these higher price targets…

It’s already too late.

The institutional money already came in and helped push the stock higher.

And everyday folks are left on the outside just looking in as these rich investors get even richer.

But with this 1-2-3- pattern….

Everyone here today has a chance to get ahead of that potential flood of money

And that’s going to be critical in the next 60 days.

Doug Hill:

You’re saying that because you’re expecting to see a lot more of these patterns in the next 60 days?

I think you mentioned more than 1,000 opportunities?

Enrique Abeyta:

Right, I’ll explain what’s going on in just a moment…

But that’s exactly right…

And whenever you see this 1-2-3 pattern, it’s basically screaming…

“Guys, pay attention to this stock because it’s growing much faster than Wall Street analysts are expecting…. and normally that’s just the beginning of a massive trend of earnings revisions”

Let’s look at another top example with a company that has been growling like crazy called CAVA.

Have you heard of it?

Doug Hill:

It’s a restaurant chain, isn’t it?

Enrique Abeyta:

Yes, and this could be the next Chipotle.

They operate just like Chipotle, but instead of Mexican food, it serves Mediterranean food.

Take a look at this chart… as you can see here, shares were going down in late 2023…

But we got three consecutive earnings revisions in November.

And that was a sign that the company was entering a new cycle of growth that would leave most Wall Street analysts behind.

And that’s exactly what happened…

The company started opening more restaurants…

And selling more than what analysts were expecting…

And every step of the way, analysts just keep adjusting their earnings estimates higher, higher and higher.

So guess what happened with shares of Cava?

Doug Hill:

It exploded higher.

Enrique Abeyta:

High enough to turn $10k into almost $40,000 in less than a year.

Again, that’s almost 40 years of stock market gains…

In less than 12 months.

Doug Hill:

Why wait four decades if you can make the same gain in less than a year?

Enrique Abeyta:

That’s a good question, isn’t it?

There’s no reason to wait.

For example, let’s look at Carvana, a company that sells used cars online.

As you know Doug, the Federal Reserve spent most of 2022 hiking interest rates.

And a lot of these customers who buy cars from Carvana use financing.

So it became a lot more expensive to buy a car.

As a result, Carvana saw a huge decline in demand, and shares crashed 98%!

Take a look…

Doug Hill:

Wow… that’s brutal. It looks like it is going straight to zero.

Enrique Abeyta:

You can see that the earnings kept getting revised lower, lower and lower…

One analyst from Morgan Stanley even cut the price target from $68 to just $1.

So it really looked like the company was going bankrupt.

In fact, in early 2023, TheStreet.com was talking about possible bankruptcy…

Other analysts were calling it a “zombie company” and predicting the stock could go to zero.

Doug, does that sound like a great investment to you?

Doug Hill:

No, but I think I know where you’re going with this…

Enrique Abeyta:

Watch what happened in March 2023…

We got three consecutive rises in earnings estimates… indicating the beginning of a new trend of revisions.

Even though things were looking bleak…

This was a strong indication the company was turning around…

And entering a new phase of growth.

And that’s exactly what happened.

But Wall Street analysts were so pessimistic, that they didn’t see the turnaround coming…

So they spent most of 2023 and 2024 raising their estimates…

Playing catch up.

And of course, the stock followed higher…

And anyone who invested $10k when the pattern appeared…

Had a chance to turn that into a mind-blowing $233,000 in less than two years.

Doug Hill:

My goodness, Enrique…

That’s another six-figure nest egg right there… in less than two years.

Unbelievable…

Especially when you consider that the stock basically came back from the dead.

Enrique Abeyta:

Without this pattern, it would have been almost impossible to pinpoint that turnaround.

So, Doug, can you see why I said earlier that earnings estimate revisions are the most powerful force impacting stock prices?

Doug Hill:

Absolutely. And just to reiterate… This is just with STOCKS! This is not with options or anything risky.

Enrique Abeyta:

That’s why I said earlier that once you know how to spot this pattern…

Making money in the market could be as simple as 1-2-3.

Doug Hill:

Yeah, and now that you covered all the basics, I can see why this pattern preceded all of the top 10 performing stocks of 2024.

Enrique Abeyta:

Well, I’m glad you brought that up…

Because I believe this pattern will also predict the top 10 performing stocks of 2025, just like it did in 2024.

So I spent the last few months looking for the stocks that are experiencing multiple earnings revisions.

Remember, that means these companies are growing much faster than what analysts are expecting…

So they have to keep adjusting their earnings estimates…

And raising their price targets.

I found 10 stocks that meet those criteria.

I believe these could very well be the top performers of 2025

I put all the details inside a brand-new report called Maverick Moves: My Top 10 Stocks for 2025.

And I’m making this report available to everyone here today.

Each of those stocks has the potential to produce years of stock market gains in the next 12 months…

Meaning they could help you accelerate your retirement.

Doug Hill:

That’s fantastic.

Enrique Abeyta:

And that’s not all.

There’s actually another report I want to give everyone that will help them prepare for the coming 60-day retirement accelerator window.

You see, I’ve developed an accelerated version of this strategy that’s perfect for the coming 60 days.

All the examples I’ve shown you so far were opportunities to compress decades of stock market gains into just a few years.

But with this new version of this strategy…

You could make the equivalent of years of stock market gains in just a few days

Doug Hill:

So it’s the same strategy, but in a shorter time frame?

Enrique Abeyta:

Exactly.

I already shared this with a small group of readers in a separate endeavor, and the results have been incredible.

Doug Hill:

So the gains are much faster?

Enrique Abeyta:

Much faster.

Let me give you an example.

There should be another chart coming up.

You can see here that analysts are still revising earnings for Nvidia higher and higher…

And that has put the stock in a long-term uptrend.

So with this accelerated strategy, I’m using a few other indicators to buy the stock during a short-term dip for an accelerated gain.

In this example, I targeted an ETF that tracks the prices of semiconductor companies like Nvidia…

And anyone who followed my recommendation, had a chance to make more than 3 years of stock market gains in just six days with a 35% gain.

Doug Hill:

Are you using options for these trades?

Enrique Abeyta:

No options. No futures. Nothing extra risky.

We’re just buying shares of the stock at the right time…

During a short-term correction, before it resumes the long-term uptrend.

For example, when we targeted Netflix, analysts had been raising earnings estimates, as you can see in the chart…

So I recommended a trade, and anyone who followed my recommendation had a chance to make almost three years of stock market gains … almost 30%…again in just 6 days.

Doug Hill:

And just to be clear, these are not hypothetical examples.

These are real trade ideas you sent to readers?

Enrique Abeyta:

Correct.

For example, when we targeted Chinese online retailer PDD Holdings, you can see that earnings estimates were getting revised higher, higher and higher.

So we timed the stock perfectly for a short-term gain…

And anyone who followed our recommendation had a chance to make more than 4 years of stock market gains in less than a month with a 45% gain.

Doug Hill:

We actually have a note from one of your readers who followed your recommendation. He wrote in to say…

I’m sure that $55 grand in just weeks will help him accelerate his retirement.

Enrique Abeyta:

Doug, we’ve been able to do this again, again and again…

We did with NRGU, an ETF that tracks oil stocks like ExxonMobil. 30% in just 4 days.

We did it with chipmaker Qualcomm, 21% in less than a month…

And we did it with Devon Energy, 17% in 3 weeks.

And it’s these types of accelerated trades that I’ll be targeting in the next 60 days.

In fact, I just identified the top three trades for the coming 60-day retirement accelerator window.

And I put all the details in another report called Maverick Aces: Three Accelerated Trades For a 60-Day Profit Blitz. I want to give everyone here access because we don’t have much time.

This 60-day window is starting right now.

Doug Hill:

So the first report, Maverick Moves: My Top 10 Stocks for 2025, will give folks a chance to profit in the long-run…

And this second report, Maverick Aces: Three Accelerated Trades For a 60-Day Profit Blitz, will give folks a chance to profit in the coming days.

That’s great news.

But before you show us how folks can claim those reports…

Can we talk about this 60-day retirement accelerator window?

You mentioned earlier that you believe we’re about to see a massive market shift.

What exactly is happening in the next 60 days?

Enrique Abeyta:

I believe we’re about to see a massive new wave of earnings revisions in the next 60 days….

And it’s all thanks to Artificial Intelligence.

Now, I know that at this point everyone is probably sick of hearing about AI.

But I promise, nobody is talking about this shift I see coming.

You see, so far this AI boom has been concentrated in the companies that are building the infrastructure that will enable all sorts of AI applications.

I’m talking about chip makers like Nvidia, AMD and Taiwan Semiconductor…

And cloud-computing services like Microsoft, Amazon and Oracle.

These are the AI enablers…

And so far they have been the biggest beneficiaries of this AI boom because every single company that’s adopting AI has to buy their products.

That’s why earnings of these enablers have exploded in recent years.

But I believe we’re about to see a big market shift.

I believe in the next 60 days we’ll begin to see an expansion of this AI boom…

Where the biggest gains will move from these enablers to AI adopters.

I’m talking about companies that will begin to use AI to cut costs and increase their profits.

Doug Hill:

So let me see if I get this right…

You’re talking about an expansion in this AI boom, where it won’t just be Nvidia and these chip companies, but other companies that are actually using AI in their businesses…

Enrique Abeyta:

Correct.

As Barron’s says…

I believe it will happen across several industries.

For example, there’s a fintech company called Klarna that’s applying AI in its customer service.

In just one month, the AI chatbot had 2.3 million conversations…

Doing the work of 700 full-time agents with greater accuracy and cutting the average time to resolution from 11 to 2 minutes.

Think about that… one AI doing the work of 700 people… and doing it better.

They estimated that the AI assistant will save $40 million a year.

That means their earnings should go up a lot.

Insurer UnitedHealth Group is starting to use AI to process claims.

Retailer Walmart is using AI to optimize its inventory based on anticipated demand.

Oil company Baker Hughes is using AI to drill more efficiently.

This is happening across all industries.

And according to Goldman Sachs…

AI could boost earnings nearly 20% by replacing human jobs.

Now, Doug, here’s the key…

In the next 60 days…

More than 1,000 companies will be reporting their earnings and making projections for 2025…

Many of these companies are AI adopters that I predict will begin reporting better than expected numbers, triggering a new wave of revisions.

And I should say this, too…

Now that President Trump is back in the White House, AI adoption will hit warp-speed.

Trump is a big supporter of AI and will ensure American companies lead the way.

That’s huge and it’s leading to a fast wave of opportunity.

Doug Hill:

So you believe we’re going to see a lot more 1-2-3 patterns in the coming 60 days?

Enrique Abeyta:

A lot more.

I’m expecting my computer screen to light up like a Christmas tree in the next 60 days…

Starting right now with those top three trades I’m recommending.

Like I mentioned before I just put together a special report called Maverick Aces: Three Accelerated Trades For a 60-Day Profit Blitz…

And I’m recommending my readers get in now, because these are fast moving trades designed to return years of stock market gains in just a few days.

Doug Hill:

Let’s not waste any more time then.

Folks, I actually have some fantastic news for you.

This is part of a much bigger project Enrique is launching today.

It’s a new venture called The Maverick.

Anyone who joins him today will gain immediate access to both of the reports I’ve mentioned so far…

Maverick Moves: My Top 10 Stocks for 2025

And Maverick Aces: Three Accelerated Trades For a 60-Day Profit Blitz

Enrique, can you talk a little more about this new research service?

How does it work?

Enrique Abeyta:

Sure.

Every week, I’m going to run my system and do my own analysis, looking for fast-money opportunities that could help you accelerate your wealth journey.

So all you have to do is read my alerts and decide if you want to participate.

And when it’s time to close the trade, I’ll send another alert.

It couldn’t be any easier.

We’ll also be doing a live Zoom call.

Something I call The Power Hour.

I’ll be analyzing what’s going on in the market… discussing the hottest sectors…

And giving you an update on our open trades.

You’ll feel like you’re just looking over my shoulder.

Plus, you’ll be able to chat with me in real time …

For example, if you want me to look at a particular stock to get my opinion, you’ll be able to make that request.

I can’t give personalized investment advice, but feel free to ask anything you want about my views on the market and my strategy.

Doug Hill:

Folks, I just want to remind you that we’re talking to a Wall Street legend who managed nearly $4 billion.

When Enrique used to run a hedge fund, his clients had to invest a minimum of $1 million.

So this was an elite hedge fund that served rich institutional investors.

Normally everyday folks would never get access to someone like Enrique and his strategies.

But today, you have a chance to put this Wall Street maverick to work for you

Every single week he’ll send you a new fast-money trade idea designed to help you accelerate your wealth journey…

And potentially book massive gains in just a few days.

Aside from everything he mentioned so far…

He’s also prepared a series of special bonus gifts.

For example, when you join The Maverick today, you’ll also gain access to another bonus report called The Danger Zone Trio: 3 Stocks to Ditch Before Disaster

Like Enrique showed us today, this stock predictor works both ways…

When analysts are cutting earnings estimates, the stock tends to crash.

And that’s exactly what’s happening with these three stocks, isn’t that right, Enrique?

Enrique Abeyta:

Right, these are popular stocks that could be sitting in the portfolio of many folks.

But behind the scenes, analysts have been cutting their estimates…

And I believe it is just a matter of time before the stock follows and moves a lot lower.

So I’m recommending everyone stay away from these stocks… and if you own any of them, sell them immediately.

Doug Hill:

Folks, that report is yours free of charge when you join The Maverick.

You’ll also gain access to another report called The Maverick Blueprint: Your Quick Start Guide to 1-2-3 Profits.

It’s very short, but it will help you get started…

No matter your level of trading experience or expertise.

There’s more…

You’ll also gain access to a 5-part video series called The Insider’s Edge Video Series: Secrets from a Billion-Dollar Fund Manager.

It covers everything Enrique has learned managing billions over 25 years…

Which is why I believe this video series will put you ahead of 99.99% of people.

And of course, you’ll get immediate access to the special reports we’ve mentioned…

Maverick Moves: My Top 10 stocks for 2025

And Maverick Aces: Three Accelerated Trades For a 60-Day Profit Blitz.

In just a moment, he’s also going to give away the names of two tickers – for FREE.

One stock to buy… and one stock to avoid.

Enrique Abeyta:

Sorry to interrupt, Doug…

But before I get to that, there’s one more special report I want to give to everyone who becomes a charter member today.

I think everyone will love this one because…

It could help folks accelerate their gains even more

Let me show you what I mean using some of the fast-growing stocks I mentioned earlier…

Like Nvidia.

As you can see, over a two-month period, shares jumped 23%…

That means anyone who invested $10,000 had a chance to make $2,300.

Not bad.

But look what happens when you use an options strategy for the same stock, during the exact same period.

This particular options trade jumped 72% higher. It’s the same stock.

During the same period.

But it jumped three times higher. That’s the power of options. Now look, up till this point we’ve just been talking about stocks, but a lot of investors use options to magnify returns. And that makes sense. So I want to give you that opportunity to accelerate gains even more – on the same stocks that have the 1-2-3 pattern.

Here’s an example, look at CAVA.

In two months, shares jumped a whopping 45%.

Doug Hill:

That’s great.

Enrique Abeyta:

Great return.

But you know what’s even better?

240% during the same period.

Take a look… that’s more than five times more money.

It’s the same story with Carvana.

It’s up 68% during this same 60-day period.

Incredible gains.

But anyone who traded options, had a chance to make much more money…

357% during the same period.

That would be a profit of $35,700 on a $10k initial investment.

As you can see, options allow you to multiply your gains even more.

And I just found five explosive options trades on five companies showing the 1-2-3 pattern.

I put all the details inside a special report called The Maverick’s Melt Up Playbook: 5 Options to Send Your Stocks into High-Gear.

And folks, if you don’t have a lot of experience with options, don’t worry…

Because I also cover all the basics inside that report.

And it’s yours free the moment you join me today.

Doug Hill:

Amazing.

Enrique, it seems like you thought of everything.

You’re really making this a no-brainer.

So here’s the deal, folks…

When Enrique was running his hedge fund….

His clients had to invest a minimum of $1 million… and pay a minimum fee of $20,000 a year.

But he’s not publishing this for rich folks.

He’s publishing this to everyday folks like you who want a chance to accelerate their retirement.

For that reason, The Maverick will not cost anywhere near that.

The retail price is just $5,000.

But since this is a brand-new research service…

We’re giving a huge discount to charter members.

Today, you can join for just $1,795.

But it’s only available for a limited time.

Enrique’s publisher reserves the right to shut this offer down at any moment.

So if you don’t act now, you’ll risk having to pay the full retail price later.

Right now, there should be a button that says “join now” on your screen.

JOIN NOWGo ahead and click on that button because….

With just one trade, you could easily more than pay for the entire subscription

Here’s why I say that…

Anyone who invested $10,000 in some of Enrique’s very best fast money opportunities from his other research service…

Already had a chance to make a profit of…

- $3,088 in six days…

- $3,455 also in just six days…

- $4,511 in less than a month…

Just to mention a few.

In other words, your first trade recommendation alone could easily pay for your entire annual subscription in a matter of days.

That’s why I think that price is a no-brainer.

So click on that button now to lock in this offer…

JOIN NOWAnd you’ll be amongst the first ones to get your hands on this report with Enrique’s top 10 stocks for 2025…

Plus the report with his top three short-term trades for the next 60 days…

And everything else we mentioned today.

When you click on that button…

It will take you to a separate page where you can see all the details of this offer one last time before you join.

And don’t worry….

You’ll get to keep watching the broadcast and our Q&A because when you click on that button, it opens up a separate window.

You won’t miss a thing.

But remember, this offer is only available for a limited time.

If you close this page and come back later…

You’ll risk having to pay a lot more to access Enrique’s research.

Folks, 60 days from now, your life could be completely different.

But it will only be possible if you act now.

Don’t delay.

The 60-day retirement accelerator window is open right now.

Like Enrique showed us today, more than 1,000 companies will be reporting earnings in the coming 60 days…

And thanks to the application of AI, he’s expecting a new wave of earnings revisions.

With Enrique’s strategy, you’ll know exactly which stocks to target and which ones to avoid.

Now we never recommend you invest more than you can afford to lose,

But this could be your only chance to accelerate your wealth journey…

And potentially make years of stock market gains in a matter of days….

And do it over and over again.

So don’t wait.

Click on the button now to get started.

JOIN NOWYou’ll also be protected by Enrique’s DOUBLE Satisfaction Guarantee

Here’s how that works…

First, if during the next 90 days you don’t feel that joining Enrique was one of the best financial decisions you ever made…

Simply call our customer service team, and you’ll get a full credit, good for any product published by Paradigm.

Second, if in the next 12 months you don’t see at least 10 chances to accelerate your retirement in the model portfolio… at least 10 chances to make more than a year of S&P gains in a matter of days…

Simply call our customer service team, and we’ll give you an extra year of access, completely free of charge.

Enrique, are you sure you want to make these guarantees?

Enrique Abeyta:

Absolutely.

I’m trying to make this decision a no-brainer for everyone.

I don’t want anyone to miss out on this coming 60-day retirement accelerator window.

Thanks to this shift from AI enablers to AI adopters…

I believe we’re about to see an explosion in earnings revisions.

And honestly, I don’t know if we’ll ever see an opportunity this good ever again.

Doug Hill:

Folks, the way I see it, you have three choices right now…

First, you can pretend you didn’t even watch this presentation.

You can bury your head in the sand and forget about this 1-2-3 pattern…

You can pretend that this is not the #1 stock predictor…

Even though it already appeared before the top 10 performing stocks in 2024 began to skyrocket.

So that’s your first option.

You can do nothing and miss out on this coming opportunity to accelerate your retirement.

Your second option is to do your own research and try to find the stocks that are seeing a ton of revisions in their earnings estimates.

Now, like Enrique mentioned before…

There’s only one place he knows that tracks this data.

It’s a Bloomberg terminal.

It’s a computer software system that pretty much all the Wall Street pros use.

And it’s not cheap.

Enrique personally pays about $52,000 a year to have access to this type of data.

So if you’re willing to pay that much…

And if you’re willing to spend hours researching thousands of stocks to see which ones could be prime for a short-term move….

Then who knows…

Maybe you’ll be able to pick the right stocks.

The third option of course is to click on that button to join Enrique…

JOIN NOWAnd take advantage of all the work he’s already done.

You can simply read all his research, get the details on these 3 trades for the next 60 days…

Get the names of his top 10 stocks for 2025…

And then get a new trading idea every week from a hedge fund legend who’s made millions for his clients on Wall Street.

Ask yourself… which one of these three options would be easiest for you?

Which one of these options has

the best chance to accelerate

your wealth journey?

Only you can answer that.

But if you think about it…

It doesn’t make much sense to pay that $52,000 fee and spend hours looking at charts and financial numbers…

When you can have Enrique work for you for a tiny fraction of that fee.

That’s what some of his past readers chose to do…

And they’ve had some incredible results.

And I say that because I’ve seen some notes Enrique has received.

Let me share a few of the best…

Shawn C. wrote in saying:

Jeff C. said:

Bart said:

Again, that’s more than enough to pay for two years of annual subscription… from just one trade.

One of his readers even made millions from just one of Enrique’s recommendations.

Mark bought TLN a few months after his alert in April 2024 and he’s still holding. And he sent us a video telling his story.

Let’s hear it…

Folks, as you can see, Enrique’s research is already changing people’s lives.

You could be the next success story, regardless of your level of experience.

So click on that button to get started…

Because we’re about to begin our Q&A now…

And Enrique is about to give away the name of one stock to buy and another one to avoid.

But before we get to that, Enrique…

2024 was a great year for the stock market….

But what if we see a big correction or even worse, what if the stock market crashes?

Enrique Abeyta:

Well, I’ll start by saying I don’t see that happening. It’s quite the opposite, actually. But to answer your question, that wouldn’t be a problem at all.

Doug, as you mentioned earlier…

I made money from all of the biggest stock market crashes over the past 25 years…

Including the 2001 dot-com bust… the 2008 global financial crisis and the 2020 COVID crash.

And earnings revisions are a big reason why I’ve had so much success.

Like I showed earlier, it works both ways, up and down.

So if I see that earnings estimates are declining, I’ll avoid that stock.

And that alone could save you from big losses.

When you focus on only stocks that have rising estimates, you put the odds in your favor.

Let’s look at what happened in 2022, for example.

It was a terrible year for the stock market.

The S&P 500 dropped 18%.

So let’s look at my track record from my other endeavor….

We had 73 trades that year with an 80% win rate.

That’s pretty darn good for a bad year.

Normally even the best traders only have a 50% or lower win rate.

For example, George Soros had a 30% win rate while the Medallion Fund, the best money making machine in history, had a little bit more than a 50% win rate.

And when you consider that we’re just buying stocks, and not shorting or buying put options…

Then that win rate in a bad year is even more impressive.

How did we pull this off?

Because we were buying stocks that were in well-established uptrends (despite the bear market)…

And buying them when they were down.

The truth is… even in down markets, there’s always a bull market somewhere…

And the rising earnings estimate can help you find those bull markets.

If you can buy those stocks when they have a short-term correction, you can do pretty well.

And that’s another benefit of these short-term trades.

If there’s a bear market, you don’t need to leave your money exposed to long-term market volatility.

You can just get in and get out a few days or a few weeks later, and just take advantage of all short-term volatility.

Doug Hill:

Thanks for clarifying.

All right, Folks, we’re going to get started with our Q&A now…

Please stick around because Enrique is about to give away the name of one stock to buy and another one to avoid in 2025.

All right, Enrique, here’s the first question I have for you…

“What happens after the

60-day period?”

Enrique Abeyta:

That’s a great question.

Like I mentioned before, more than 1,000 companies will be reporting earnings in the coming days.

That’s critical for us because when these companies report earnings for this past quarter…

They’ll also provide future guidance for 2025.

And analysts use those guidelines to make their own assumption about future earnings.

So we tend to see a lot of revisions during earnings season.

But this revision process never stops.

Analysts are constantly getting new information about the market, sales, consumers, etc.…

So anytime they get new information, they might update their estimates.

Doug Hill:

So, it’s not just during earnings seasons that you see these opportunities?

Enrique Abeyta:

Not at all.

We do tend to see more of them during earnings seasons.

But analysts can revise their estimates for a particular company anytime.

That’s why I’m expecting to recommend a new trade every single week.

Doug Hill:

I guess that’s great news for members of The Maverick.

Folks, remember, you can get started right now with Enrique’s top three trades for the next 60 days.

Click on that button to get started.

Here’s another question…

“Enrique, why did you leave Wall Street? it seems like you had a very successful career.”

Enrique Abeyta:

Look, Wall Street for me is a competition among some of the smartest people in the world.

And I truly love that game.

But it’s very demanding because aside from picking stocks, you also need to raise money, manage people, deal with compliance, and all the operational stuff.

If I had stayed on Wall Street, I doubt I’d have much time for my kids.

I have three young kids, and I don’t want to miss their childhoods. And that’s the main reason why I left.

And when I saw this opportunity to share my ideas with everyday folks, it just seemed perfect to me.

Because I can focus only on picking stocks, which is what I truly love to do. I don’t have to raise or manage money.

Doug, I could go work with a billionaire and famous hedge fund manager like Dan Loeb.

I’m friends with Bill Ackman, for example… who’s another famous hedge fund manager.

But I don’t want to go back to Wall Street.

I want to do this. I believe in this business. I enjoy helping everyday folks with my ideas. I like writing. I like doing the videos. It’s also a better lifestyle that allows me to be a better father to my children.

Doug Hill:

Well, I’m really glad you’re doing this because after everything you showed us…

I’m confident your research will help a lot of folks.

All right, here’s another question…

“Enrique, you just mentioned your high win rate in 2022, so can you explain more how you manage risk?”

Enrique Abeyta:

Look, all the best traders in the world know that when it comes to investing and trading, the #1 rule is to not lose money.

Of course, that’s impossible.

Everyone has losses.

But if you have that mentality and the goal of not losing money, ever… It just helps minimize losses whenever they happen.

And we try to do that by using tight stop losses whenever we see that the stock is losing momentum.

Doug Hill:

That’s great.

Folks, I just want to remind you that one single trade recommendation could more than pay for your entire annual subscription.

Just listen to this note we got from one of Enrique’s readers…

![Ed B.: “I’m up 53% in Vistra [in about six months], profit of $37,000. I’m up 55% [in five months] in Talen, profit of $51,000. I upped my membership for another year. If just Talen plays out how you think, the fee pays back 10,000x!”](https://d2z65klgtz99km.cloudfront.net/MVK/mvk_launch_1124/MVK_GFX_FS_30_800x450.webp)

So go ahead and click on that button to secure this discounted offer. It’s only available for a limited time.

JOIN NOWAll right, Enrique, before we move on to the next question…

I want to talk about your career a bit because a lot of folks who joined us today don’t know you yet.

They don’t know how you were able to go from being dirt poor and homeless to managing billions on Wall Street.

And I find that story fascinating.

It’s the true American dream.

So can we talk about that?

Enrique Abeyta:

Yeah, I came from a very difficult childhood.

My mother was a political immigrant to this country. She came from Uruguay in South America where there was a military dictatorship.

It ended up with most of my family being exiled across the world.

My father grew up out west. He was born in Black Hills, South Dakota.

He was a true child of the American West.

My grandfather was a New Mexican, Mexican. My grandmother was German and Scotch Irish.

They grew up hard. There was a history of alcoholism and poverty. This ended up playing out in my childhood. I had a very difficult time too.

Doug Hill:

So your dad had an alcohol problem?

Enrique Abeyta:

He did.

And there was a period of time when we were homeless for a couple of days.

We had to sleep in our car behind the fleabag motel that we couldn’t afford anymore.

It’s very challenging, but I was incredibly lucky to have a fantastic mother who was able to guide me through that period.

She put me in a position to succeed.

The most important thing that she taught me throughout all of this, throughout all the difficulties that I had growing up, was that optimism wins.

She taught me that as long as I worked hard, I could be successful in life.

So I did very well in school.

And when it was time to go to college, I knew I didn’t want to be poor.

Back then, 30 years ago, one of the best ways to get rich was to go to Wall Street.

And the best place to get prepared for Wall Street was, and still is, the Wharton School at the University of Pennsylvania.

They have the best business program in the world.

So I got myself into that program, the same program that trained Peter Lynch, Warren Buffett, and President Trump.

So after I graduated I spent 25 years managing hedge funds on Wall Street…

I made millions for myself and for my clients.

Doug, some people say that money can’t buy happiness…

But I’ll tell you what…

I’ve been dirt poor…

And I’ve made millions…

I can tell you from personal experience that having a lot of money is a lot better than having none.

Because it gives you options to do things you want to do… it gives you freedom.

For example, one of the first things I did when I made my first couple million dollars was I went to my mom and wrote her a check for half a million dollars and said, “Mom, you never have to work another day again in your life.”

She insisted on working for the next 10 years!

But it felt really nice to be able to do that for my mom.

And that’s what money can do.

Maybe it can’t buy happiness, but it can definitely solve all the money problems.

And that brings me to this venture I’m launching today…

I know that with all the inflation we’ve seen in recent years, a lot of folks are falling behind in their retirement plans…

And my goal is to help folks accelerate their wealth journey so they can reach their retirement goals.

I went through a lot of financial hardship, and I don’t want anyone to have to go through that stress of not having money.

Doug Hill:

Yeah, just based on the comments from some of your past readers we’ve shared here today…

I think you’re doing a pretty good job at it.

Folks, all the stories and notes we shared before are coming from real people just like you who already tried Enrique’s strategy.

Now it’s your chance.

The 60-day retirement accelerator window is open right now

60 days from now your life could be completely different.

But only if you act now.

So click on that button to get started.

JOIN NOWAll right, Enrique, here’s another question…

“If you’re right about this shift from AI enablers to AI adopters, what happens to Nvidia in 2025?

Enrique Abeyta:

Well, earnings estimates for Nvidia are still rising.

I actually recommended the stock to my readers back in August. I wrote:

And that was the right call because the stock jumped 35% higher in less than three months.

This is actually a perfect example of our short-term strategy.

Nvidia is in a long-term uptrend because of its strong earnings growth. But we took advantage of a short-term correction to grab a quick double-digit gain.

Now, to answer the question…

I believe the AI boom will expand to AI adopters.

Does that mean Nvidia will crash?

No, but I do believe Nvidia’s growth will slow down because a lot of these AI adopters already bought Nvidia chips…

They’ve made massive investments, and eventually they will cut down those investments and focus on the actual application of AI in their business.

And I believe it’s those AI adopters who will see a big jump in earnings.

Does that make sense?

Doug Hill:

It makes perfect sense.

All right, Enrique, we’re running out of time here.

So can you please give us those trading ideas you promised?

One stock to buy and another one to avoid in 2025.

Enrique Abeyta:

Sure. I’ll start with the stock to avoid.

And that is CrowdStrike, ticker CRWD, which is probably the most well-known cybersecurity firm in the world.

And here’s why…

Take a look at the earnings revisions…

This past summer the company’s software suffered a major outage that brought down millions of computers around the world.

So several analysts began to cut their estimates and lower their price target.